Question: 3. Two annuities, which your client has identified, are available for purchase. The first annuity pays $6,000 each three-month period over 4 years, at a

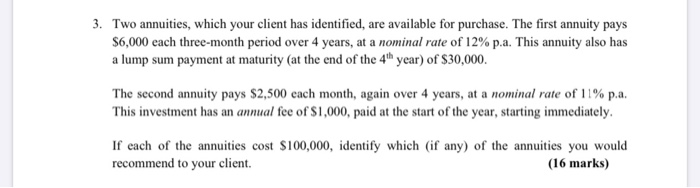

3. Two annuities, which your client has identified, are available for purchase. The first annuity pays $6,000 each three-month period over 4 years, at a nominal rate of 12% p.a. This annuity also has a lump sum payment at maturity (at the end of the 4th year) of $30,000. The second annuity pays $2,500 each month, again over 4 years, at a nominal rate of 11% p.a. This investment has an annual fee of $1,000, paid at the start of the year, starting immediately If each of the annuities cost $100,000, identify which (if any) of the annuities you would recommend to your client. (16 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts