Question: 3. Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are

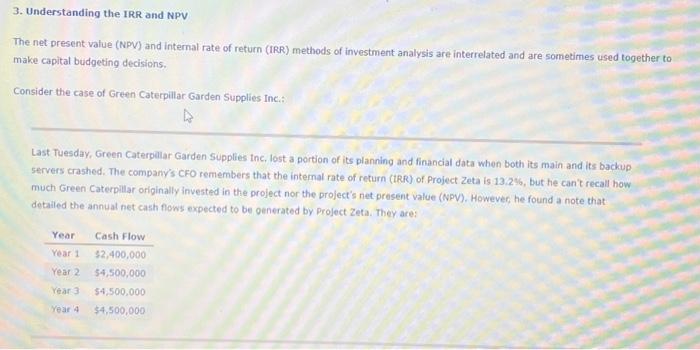

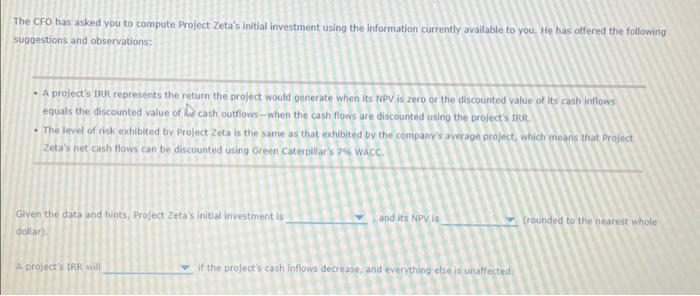

3. Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Consider the case of Green Caterpillar Garden Supplies Inc: Last Tuesday, Green Caterpilar Garden Supplies inc, lost a portion of its planning and financial data when both its main and its backup servers crashed. The company's cFo remembers that the intemal rate of return (IRR) of Project Zeta is 13.2%, but he can't recall how much Green Caterplils orfolnally Invested in the project nor the project's net present value (NPV). However, he found a note that detailed the annuat net cash flows expected to be oenerated by Project Zeta. Ther are: The CFo has asked you to compute Project Zeta's initial investment using the information currently available to you. He has offered the following sugestions and observations: - A project's IRR represents the return the project would generate when its Nov is zero or the discounted value of its cash inflows equals the discounted value of 14 cash outfiows - when the cash flows are discounted using the project's 18R. - The level of risk exchibited by Project zeta is the same as that exhibited by the company's average project, which ineans that project Zeta's net cash flows can be discounted using Green Caterpillar's 740 WACC. Given the data and hints, Project Zetas initial investment is and its NPVis (rounded to the neatest whole dollar) A prolect's IFR will If the profect's cash inflows decrease, and everything else is unaffected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts