Question: 3 ) Until 2 0 1 7 , taxpayers could deduct interest payments on up to $ 1 million of mortgage debt secured by the

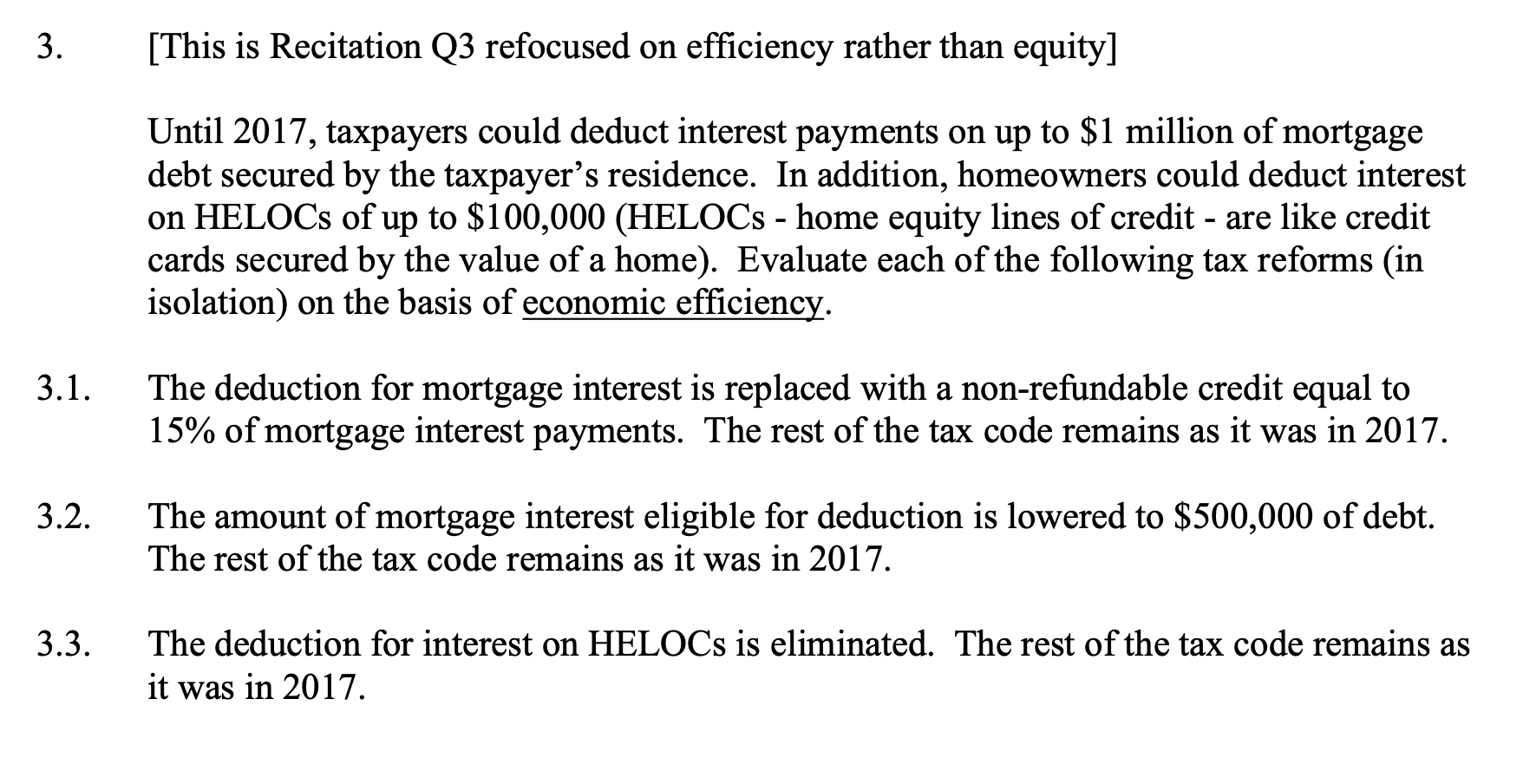

Until taxpayers could deduct interest payments on up to $ million of mortgage debt secured by the taxpayers residence. In addition, homeowners could deduct interest on HELOCs of up to $HELOCs home equity lines of credit are like credit cards secured by the value of a home Evaluate each of the following tax reforms in isolation on the basis of economic efficiency.

The deduction for mortgage interest is replaced with a nonrefundable credit equal to of mortgage interest payments. The rest of the tax code remains as it was in

This is Recitation Q refocused on efficiency rather than equity

The amount of mortgage interest eligible for deduction is lowered to $ of debt. The rest of the tax code remains as it was in

The deduction for interest on HELOCs is eliminated. The rest of the tax code remains as it was in

Until taxpayers could deduct interest payments on up to $ million of mortgage

debt secured by the taxpayer's residence. In addition, homeowners could deduct interest

on HELOCs of up to $HELOCs home equity lines of credit are like credit

cards secured by the value of a home Evaluate each of the following tax reforms in

isolation on the basis of economic efficiency.

The deduction for mortgage interest is replaced with a nonrefundable credit equal to

of mortgage interest payments. The rest of the tax code remains as it was in

The amount of mortgage interest eligible for deduction is lowered to $ of debt.

The rest of the tax code remains as it was in

The deduction for interest on HELOCs is eliminated. The rest of the tax code remains as it was in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock