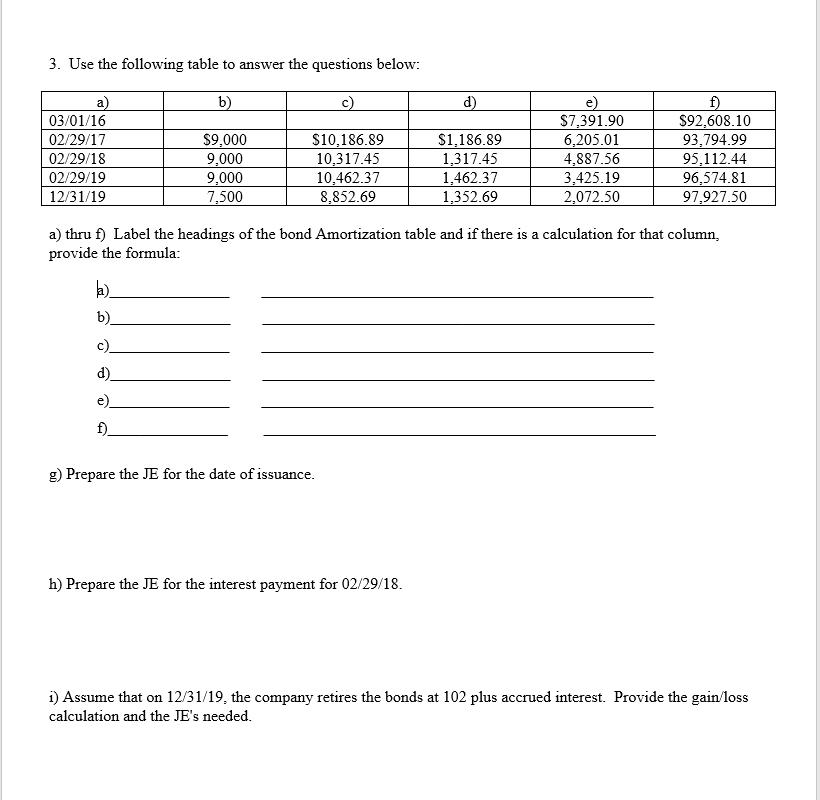

Question: 3. Use the following table to answer the questions below: b) c) $9,000 $10,186.89 9,000 10,317.45 9,000 10,462.37 7,500 8,852.69 a) 03/01/16 02/29/17 02/29/18

3. Use the following table to answer the questions below: b) c) $9,000 $10,186.89 9,000 10,317.45 9,000 10,462.37 7,500 8,852.69 a) 03/01/16 02/29/17 02/29/18 02/29/19 12/31/19 a)_ b) c) d) e) f) g) Prepare the JE for the date of issuance. d) $1,186.89 1,317.45 1,462.37 1,352.69 h) Prepare the JE for the interest payment for 02/29/18. $7,391.90 6,205.01 4,887.56 a) thru f) Label the headings of the bond Amortization table and if there is a calculation for that column, provide the formula: 3,425.19 2,072.50 f) $92,608.10 93,794.99 95,112.44 96,574.81 97,927.50 i) Assume that on 12/31/19, the company retires the bonds at 102 plus accrued interest. Provide the gain/loss calculation and the JE's needed.

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts