Question: 3. Use the same assumptions as we did above (a couple married, filing jointly, with no dependents, using the standard deductions and exemptions). Use the

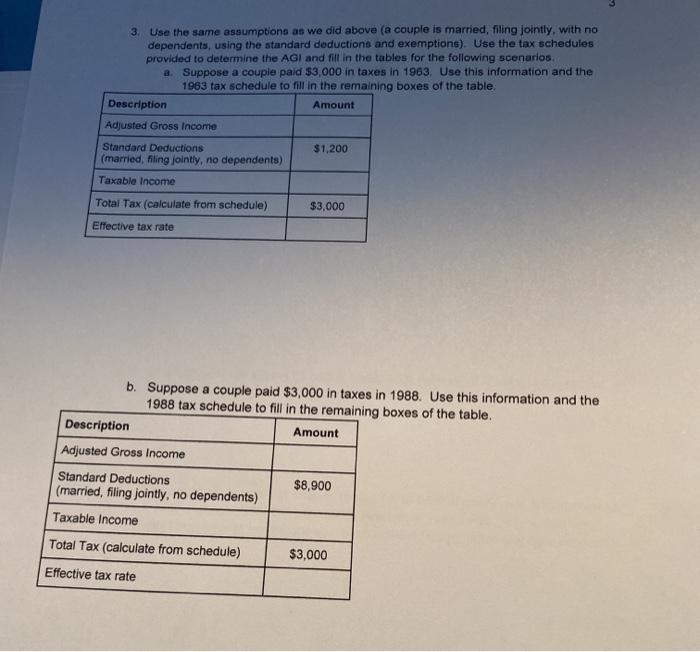

3. Use the same assumptions as we did above (a couple married, filing jointly, with no dependents, using the standard deductions and exemptions). Use the tax schedules provided to determine the AGI and fill in the tables for the following scenarios a. Suppose a couple paid $3,000 in taxes in 1963. Use this information and the 1963 tax schedule to fill in the remaining boxes of the table Description Amount Adjusted Gross Income $1,200 Standard Deductions (married, filing jointly, no dependents) Taxable income Total Tax (calculate from schedule) $3,000 Effective tax rate b. Suppose a couple paid $3,000 in taxes in 1988. Use this information and the 1988 tax schedule to fill in the remaining boxes of the table. Description Amount Adjusted Gross Income Standard Deductions $8,900 (married, filing jointly, no dependents) Taxable income Total Tax (calculate from schedule) $3,000 Effective tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts