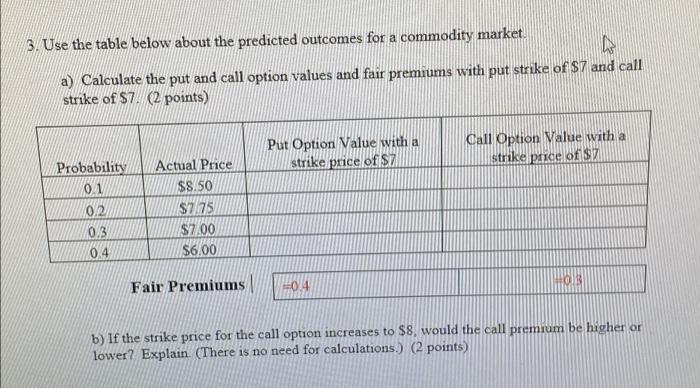

Question: 3. Use the table below about the predicted outcomes for a commodity market. a) Calculate the put and call option values and fair premiums with

3. Use the table below about the predicted outcomes for a commodity market. a) Calculate the put and call option values and fair premiums with put strike of $7 and call strike of $7.(2 points) Put Option Value with a strike price of SZ Call Option Value with a strike pride ofisi Probability 0.1 0/2 0.3 0.4 Actual Price $8.50 $7.78 $7.00 $6.00 03 Fair Premiums 04 b) If the strike price for the call option increases to $8, would the call premium be higher or lower? Explain (There is no need for calculations.) (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts