Question: 3. Using Excel, do the following. A. Create columns titled Years to Maturity (cell A1), Interest Rate (cell B1), Yearly Investment (cell C1), and Sub-Total

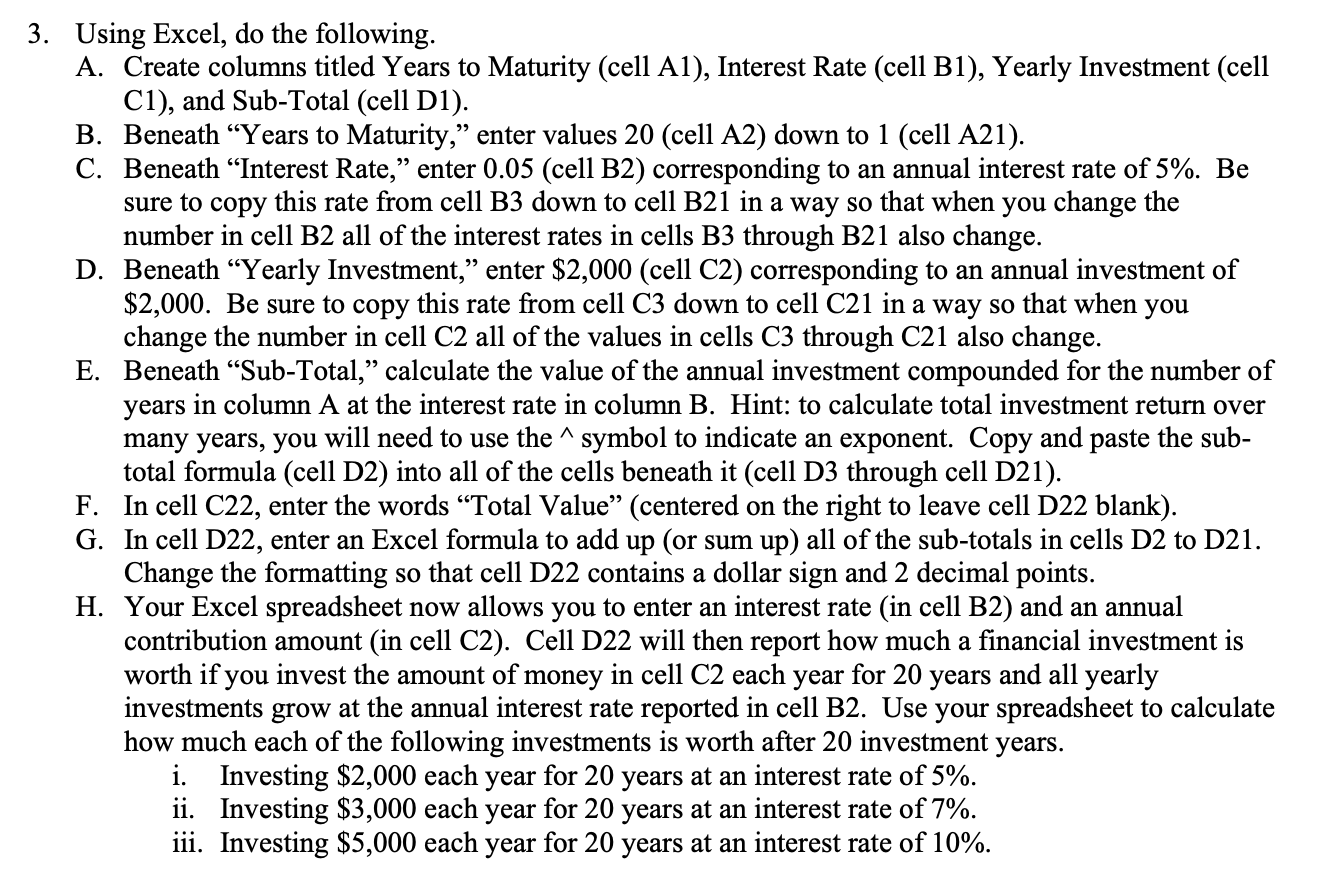

3. Using Excel, do the following. A. Create columns titled Years to Maturity (cell A1), Interest Rate (cell B1), Yearly Investment (cell C1), and Sub-Total (cell Dl). B. Beneath Years to Maturity, enter values 20 (cell A2) down to 1 (cell A21). C. Beneath Interest Rate, enter 0.05 (cell B2) corresponding to an annual interest rate of 5%. Be sure to copy this rate from cell B3 down to cell B21 in a way so that when you change the number in cell B2 all of the interest rates in cells B3 through B21 also change. D. Beneath Yearly Investment, enter $2,000 (cell C2) corresponding to an annual investment of $2,000. Be sure to copy this rate from cell C3 down to cell C21 in a way so that when you change the number in cell C2 all of the values in cells C3 through C21 also change. E. Beneath Sub-Total, calculate the value of the annual investment compounded for the number of years in column A at the interest rate in column B. Hint: to calculate total investment return over many years, you will need to use the^symbol to indicate an exponent. Copy and paste the sub- total formula (cell D2) into all of the cells beneath it (cell D3 through cell D21). F. In cell C22, enter the words Total Value (centered on the right to leave cell D22 blank). G. In cell D22, enter an Excel formula to add up (or sum up) all of the sub-totals in cells D2 to D21. Change the formatting so that cell D22 contains a dollar sign and 2 decimal points. H. Your Excel spreadsheet now allows you to enter an interest rate (in cell B2) and an annual contribution amount (in cell C2). Cell D22 will then report how much a financial investment is worth if you invest the amount of money in cell C2 each year for 20 years and all yearly investments grow at the annual interest rate reported in cell B2. Use your spreadsheet to calculate how much each of the following investments is worth after 20 investment years. i. Investing $2,000 each year for 20 years at an interest rate of 5%. ii. Investing $3,000 each year for 20 years at an interest rate of 7%. iii. Investing $5,000 each year for 20 years at an interest rate of 10%. 3. Using Excel, do the following. A. Create columns titled Years to Maturity (cell A1), Interest Rate (cell B1), Yearly Investment (cell C1), and Sub-Total (cell Dl). B. Beneath Years to Maturity, enter values 20 (cell A2) down to 1 (cell A21). C. Beneath Interest Rate, enter 0.05 (cell B2) corresponding to an annual interest rate of 5%. Be sure to copy this rate from cell B3 down to cell B21 in a way so that when you change the number in cell B2 all of the interest rates in cells B3 through B21 also change. D. Beneath Yearly Investment, enter $2,000 (cell C2) corresponding to an annual investment of $2,000. Be sure to copy this rate from cell C3 down to cell C21 in a way so that when you change the number in cell C2 all of the values in cells C3 through C21 also change. E. Beneath Sub-Total, calculate the value of the annual investment compounded for the number of years in column A at the interest rate in column B. Hint: to calculate total investment return over many years, you will need to use the^symbol to indicate an exponent. Copy and paste the sub- total formula (cell D2) into all of the cells beneath it (cell D3 through cell D21). F. In cell C22, enter the words Total Value (centered on the right to leave cell D22 blank). G. In cell D22, enter an Excel formula to add up (or sum up) all of the sub-totals in cells D2 to D21. Change the formatting so that cell D22 contains a dollar sign and 2 decimal points. H. Your Excel spreadsheet now allows you to enter an interest rate (in cell B2) and an annual contribution amount (in cell C2). Cell D22 will then report how much a financial investment is worth if you invest the amount of money in cell C2 each year for 20 years and all yearly investments grow at the annual interest rate reported in cell B2. Use your spreadsheet to calculate how much each of the following investments is worth after 20 investment years. i. Investing $2,000 each year for 20 years at an interest rate of 5%. ii. Investing $3,000 each year for 20 years at an interest rate of 7%. iii. Investing $5,000 each year for 20 years at an interest rate of 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts