Question: 3. Using the diagram below how would the ROA and the ROE change if economic conditions made borrowing money more expensive? Specifically, what would be

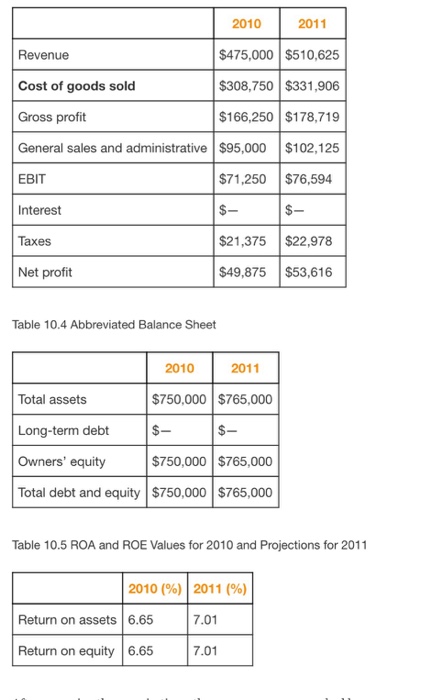

2011 2010 $475,000 $510,625 $308,750 $331,906 $166,250 $178,719 Revenue Cost of goods sold Gross profit General sales and administrative $95,000 $102,125 EBIT Interest Taxes Net profit $71,250$76,594 $21,375$22,978 $49,875 $53,616 Table 10.4 Abbreviated Balance Sheet 2010 2011 Total assets Long-term debt Owners' equity Total debt and equity $750,000 $765,000 $750,000 $765,000 $750,000 $765,000 Table 10.5 ROA and ROE Values for 2010 and Projections for 2011 2010 (%) | 2011 (%) Return on assets 6.65 7.01 Return on equity 6.65 7.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts