Question: 3. Using the following operating data, prepare the Statement Accounting for Gross Profit Variation for RED LIONS Company in 2011 under each of the independent

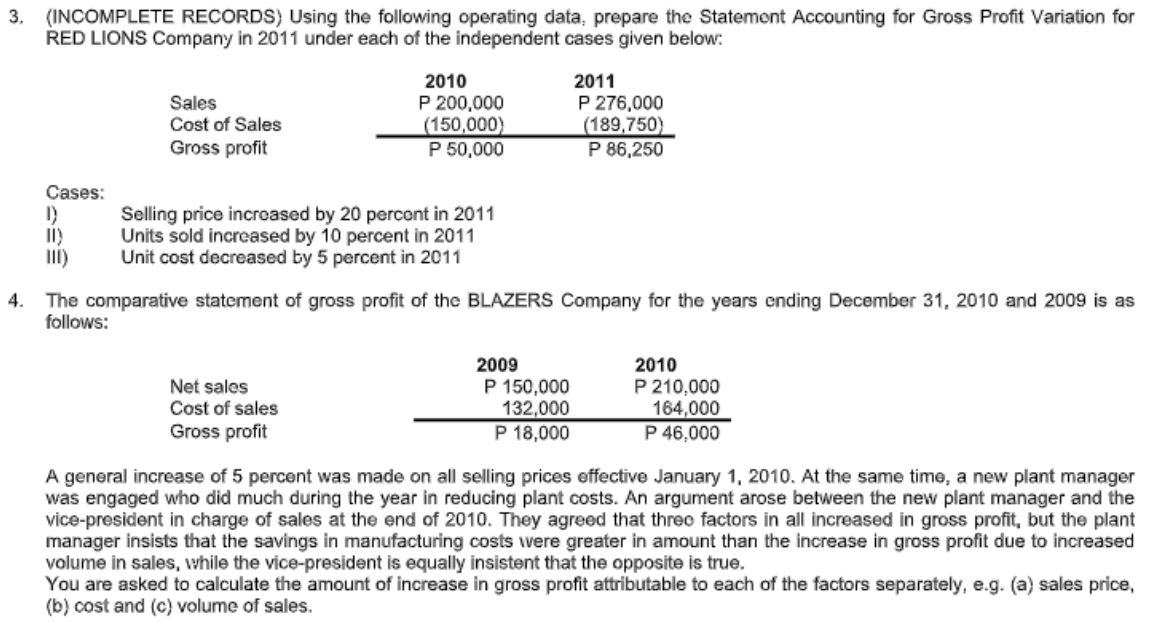

3. Using the following operating data, prepare the Statement Accounting for Gross Profit Variation for RED LIONS Company in 2011 under each of the independent cases given below:

| 2010 | 2011 | |

| Sales | 200,000 | 276,000 |

| Cost of Sales | (150,000) | (189,750) |

| Gross Profit | 50,000 | 86,250 |

Cases: I) Selling price increased by 20 percent in 2011 II) Units sold increased by 10 percent in 2011 III) Unit cost decreased by 5 percent in 2011

4.The comparative statement of gross profit of the BLAZERS Company for the years ending December 31, 2010 and 2009 is as follows:

| 2010 | 2011 | |

| Sales | 150,000 | 210,000 |

| Cost of Sales | (132,000) | (164,000) |

| Gross Profit | 18,000 | 46,000 |

A general increase of 5 percent was made on all selling prices effective January 1, 2010. At the same time, a new plant manager was engaged who did much during the year in reducing plant costs. An argument arose between the new plant manager and the vice-president in charge of sales at the end of 2010. They agreed that three factors in all increased in gross profit, but the plant manager insists that the savings in manufacturing costs were greater in amount than the increase in gross profit due to increased volume in sales, while the vice-president is equally insistent that the opposite is true. You are asked to calculate the amount of increase in gross profit attributable to each of the factors separately, e.g. (a) sales price, (b) cost and (c) volume of sales.

3. (INCOMPLETE RECORDS) Using the following operating data, prepare the Statement Accounting for Gross Profit Variation for RED LIONS Company in 2011 under each of the independent cases given below: Sales Cost of Sales Gross profit 2010 P 200,000 (150,000) P 50,000 2011 P 276,000 (189,750) P 86,250 Cases: Selling price increased by 20 percent in 2011 Units sold increased by 10 percent in 2011 Unit cost decreased by 5 percent in 2011 III) 4. The comparative statement of gross profit of the BLAZERS Company for the years ending December 31, 2010 and 2009 is as follows: Net sales Cost of sales Gross profit 2009 P 150,000 132,000 P 18,000 2010 P210,000 164,000 P 46,000 A general increase of 5 percent was made on all selling prices effective January 1, 2010. At the same time, a new plant manager was engaged who did much during the year in reducing plant costs. An argument arose between the new plant manager and the vice-president in charge of sales at the end of 2010. They agreed that threo factors in all increased in gross profit, but the plant manager insists that the savings in manufacturing costs were greater in amount than the increase in gross profit due to increased volume in sales, while the vice-president is equally insistent that the opposite is true. You are asked to calculate the amount of increase in gross profit attributable to each of the factors separately, e.g. (a) sales price, (b) cost and (c) volume of sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts