Question: 3. Using the Income Statement, identify the company's movement in revenue over the past three years. a. Has it grown? Has it contracted? Has it

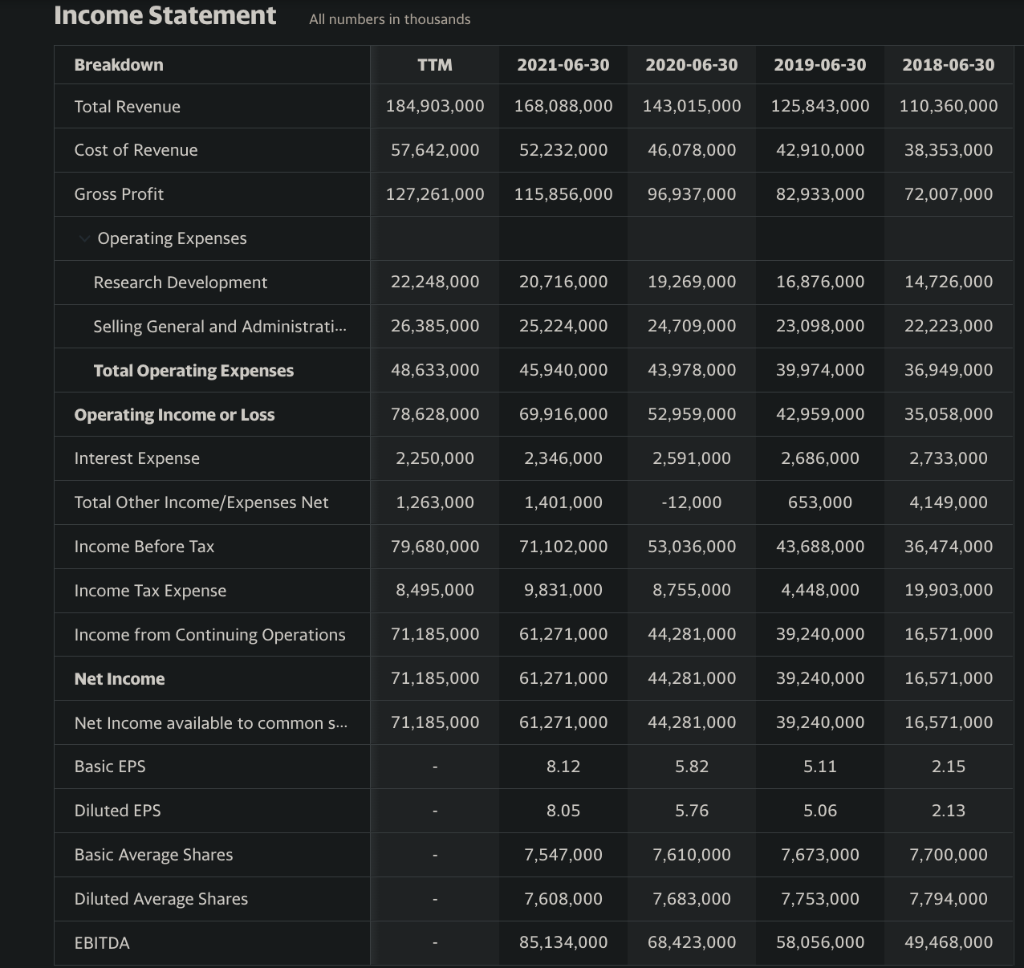

3. Using the Income Statement, identify the company's movement in revenue over the past three years. a. Has it grown? Has it contracted? Has it held stable? b. If it has grown, by what percentage has it grown? If it has contracted, by what percentage has it contracted? C. How does the movement of this company's revenue compare against that of its competitors over the same period? || Income Statement All numbers in thousands Breakdown TTM 2021-06-30 2020-06-30 2019-06-30 2018-06-30 Total Revenue 184,903,000 168,088,000 143,015,000 125,843,000 110,360,000 Cost of Revenue 57,642,000 52,232,000 46,078,000 42,910,000 38,353,000 Gross Profit 127,261,000 115,856,000 96,937,000 82,933,000 72,007,000 Operating Expenses Research Development 22,248,000 20,716,000 19,269,000 16,876,000 14,726,000 Selling General and Administrati... 26,385,000 25,224,000 24,709,000 23,098,000 22,223,000 Total Operating Expenses 48,633,000 45,940,000 43,978,000 39,974,000 36,949,000 Operating Income or Loss 78,628,000 69,916,000 52,959,000 42,959,000 35,058,000 Interest Expense 2,250,000 2,346,000 2,591,000 2,686,000 2,733,000 Total Other Income/Expenses Net 1,263,000 1,401,000 -12,000 653,000 4,149,000 Income Before Tax 79,680,000 71,102,000 53,036,000 43,688,000 36,474,000 Income Tax Expense 8,495,000 9,831,000 8,755,000 4,448,000 19,903,000 Income from Continuing Operations 71,185,000 61,271,000 44,281,000 39,240,000 16,571,000 Net Income 71,185,000 61,271,000 44,281,000 39,240,000 16,571,000 Net Income available to common S... 71,185,000 61,271,000 44,281,000 39,240,000 16,571,000 Basic EPS 8.12 5.82 5.11 2.15 Diluted EPS 8.05 5.76 5.06 2.13 Basic Average Shares 7,547,000 7,610,000 7,673,000 7,700,000 Diluted Average Shares 7,608,000 7,683,000 7,753,000 7,794,000 EBITDA 85,134,000 68,423,000 58,056,000 49,468,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts