Question: 3. Using the ratios and information given below for FLARCO, what can you say about the profitability of the firm? A) Profitability is poor for

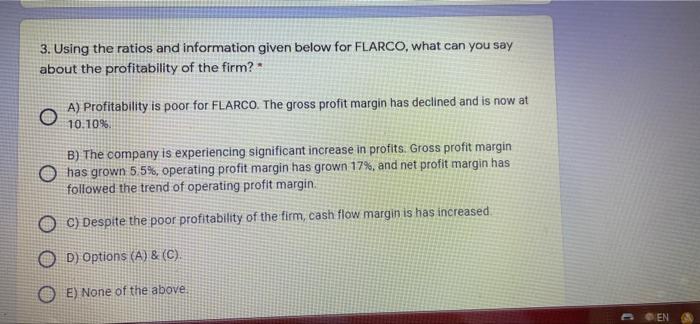

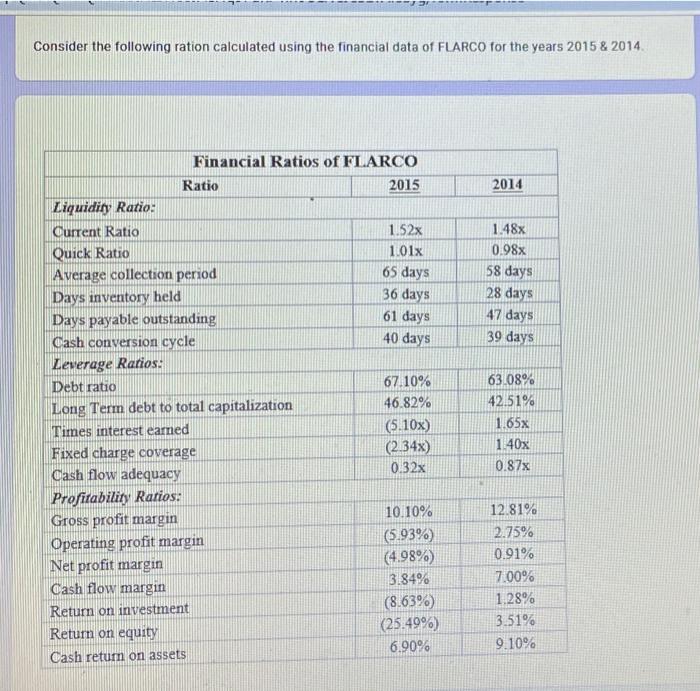

3. Using the ratios and information given below for FLARCO, what can you say about the profitability of the firm?" A) Profitability is poor for FLARCO. The gross profit margin has declined and is now at 10.10% B) The company is experiencing significant increase in profits. Gross profit margin O has grown 5,5%, operating profit margin has grown 17%, and net profit margin has followed the trend of operating profit margin C) Despite the poor profitability of the firm, cash flow margin is has increased D) Options (A) & (C). E) None of the above EN Consider the following ration calculated using the financial data of FLARCO for the years 2015 & 2014 2014 1.48x 0.98x 58 days 28 days 47 days 39 days Financial Ratios of FLARCO Ratio 2015 Liquidity Ratio: Current Ratio 1.52x Quick Ratio 1.01x Average collection period 65 days Days inventory held 36 days Days payable outstanding 61 days Cash conversion cycle 40 days Leverage Rarios: Debt ratio 67 10% Long Term debt to total capitalization 46.82% Times interest earned (5.10x) Fixed charge coverage (2.34x) Cash flow adequacy 0.32x Profitability Ratios: 10.10% Gross profit margin Operating profit margin (5.93%) Net profit margin (4.98%) 3.84% Cash flow margin Return on investment (8.63%) Retum on equity (25.49%) 6.90% Cash retum on assets 63.08% 42.51% 1.65x 1.40x 0.87x 12.81% 2.75% 0.91% 7.00% 1.28% 3.51% 9.10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts