Question: 3. Using the results from part 2 and the available information, make computations and prepare journal entries to record the following: 9. Total costs transferred

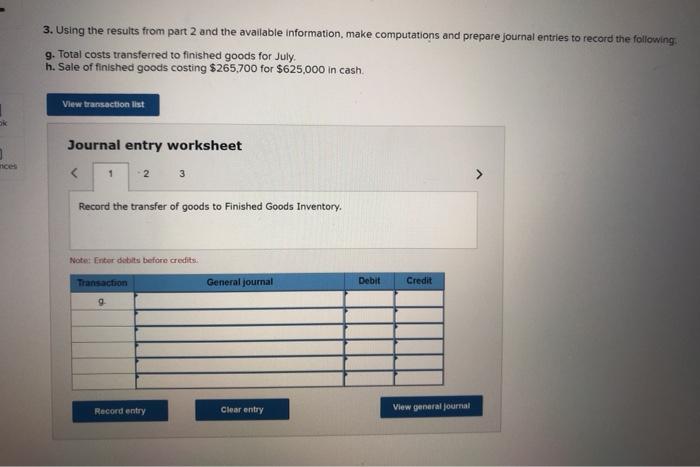

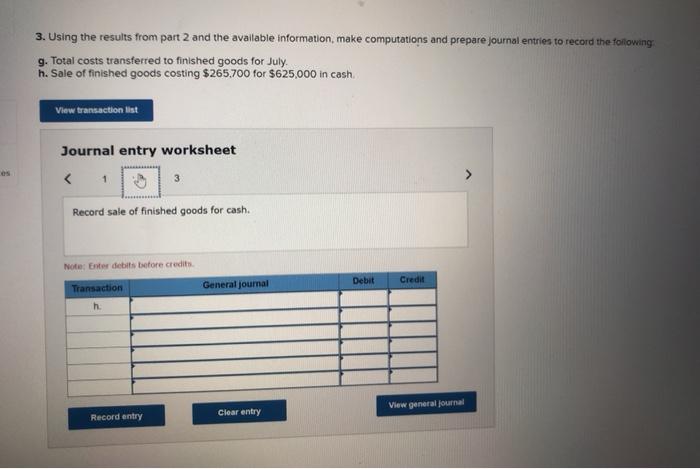

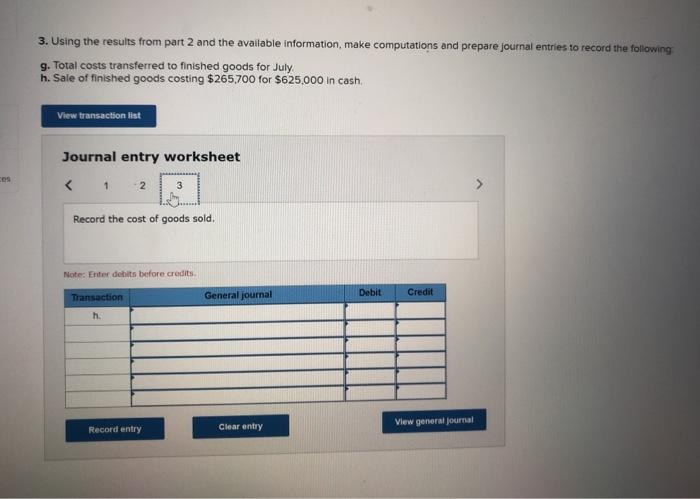

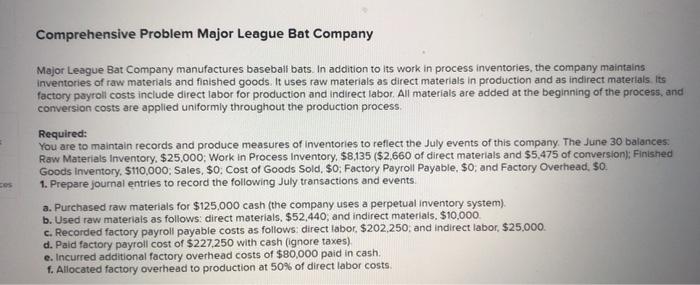

3. Using the results from part 2 and the available information, make computations and prepare journal entries to record the following: 9. Total costs transferred to finished goods for July h. Sale of finished goods costing $265,700 for $625,000 in cash View transaction list Journal entry worksheet Record the transfer of goods to Finished Goods Inventory. Note Entor dobits before credits Transaction General journal Debit Credit g Record entry Clear entry View general journal 3. Using the results from part 2 and the available information, make computations and prepare Journal entries to record the following: g. Total costs transferred to finished goods for July. h. Sale of finished goods costing $265,700 for $625,000 in cash View transaction list Journal entry worksheet 3 Record sale of finished goods for cash. Note: Enter debts before credits Debit Credit General Journal Transaction h View general journal Record entry Clear entry 3. Using the results from part 2 and the available information, make computations and prepare journal entries to record the following 9. Total costs transferred to finished goods for July h. Sale of finished goods costing $265,700 for $625,000 in cash View transaction list Journal entry worksheet ces 3 Record the cost of goods sold. Note: Enter debits before credits Debit General journal Transaction Credit h Record entry Clear entry View general Journal Comprehensive Problem Major League Bat Company Major League Bat Company manufactures baseball bats. In addition to its work in process inventories, the company maintains Inventories of raw materials and finished goods. It uses raw materials as direct materials in production and as indirect materials. Its factory payroll costs include direct labor for production and indirect labor. All materials are added at the beginning of the process, and conversion costs are applied uniformly throughout the production process. Required: You are to maintain records and produce measures of Inventories to reflect the July events of this company. The June 30 balances Raw Materials Inventory. $25,000; Work In Process Inventory, $8,135 ($2,660 of direct materials and $5,475 of conversion); Finished Goods Inventory, $110,000, Sales, $0: Cost of Goods Sold, $o: Factory Payroll Payable, $o, and Factory Overhead, $0. 1. Prepare journal entries to record the following July transactions and events a. Purchased raw materials for $125,000 cash (the company uses a perpetual inventory system). b. Used raw materials as follows: direct materials. $52,440, and indirect materials. $10,000 c. Recorded factory payroll payable costs as follows: direct labor, $202,250, and indirect labor, $25,000 d. Pald factory payroll cost of $227.250 with cash (ignore taxes) e. Incurred additional factory overhead costs of $80,000 paid in cash. 1. Allocated factory overhead to production at 50% of direct labor costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts