Question: 3) Using the Uncovered Interest Parity (UIP) equation, what would happen to the spot rate for euros if the interest rate on U.S. dollar deposits

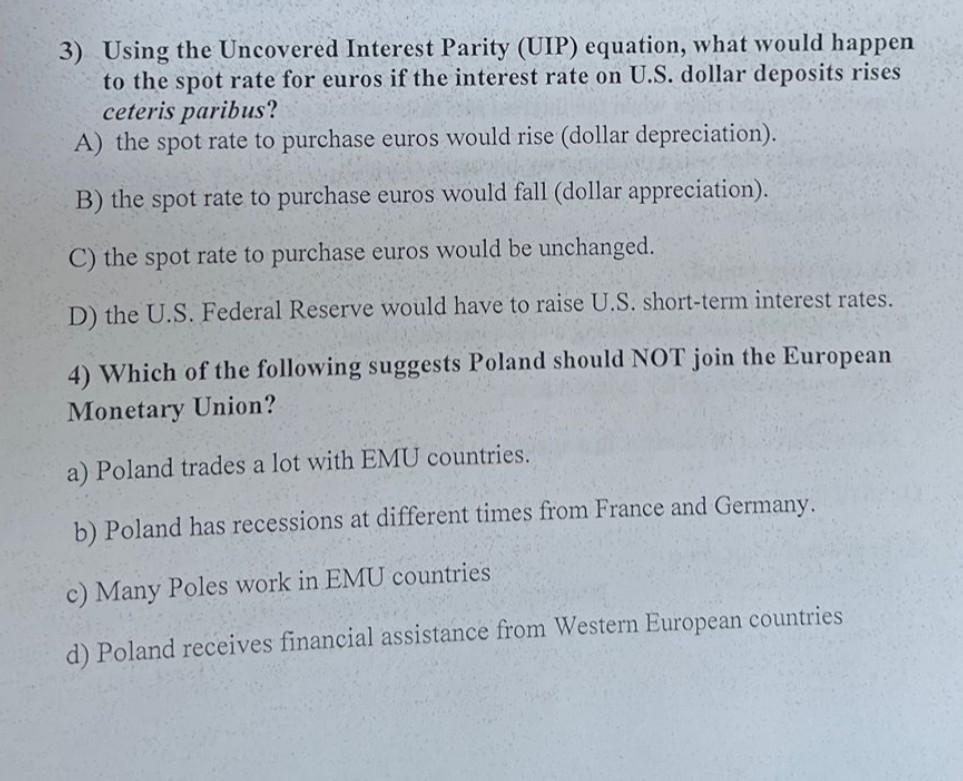

3) Using the Uncovered Interest Parity (UIP) equation, what would happen to the spot rate for euros if the interest rate on U.S. dollar deposits rises ceteris paribus? A) the spot rate to purchase euros would rise (dollar depreciation). B) the spot rate to purchase euros would fall (dollar appreciation). C) the spot rate to purchase euros would be unchanged. D) the U.S. Federal Reserve would have to raise U.S. short-term interest rates. 4) Which of the following suggests Poland should NOT join the European Monetary Union? a) Poland trades a lot with EMU countries. b) Poland has recessions at different times from France and Germany. c) Many Poles work in EMU countries d) Poland receives financial assistance from Western European countries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts