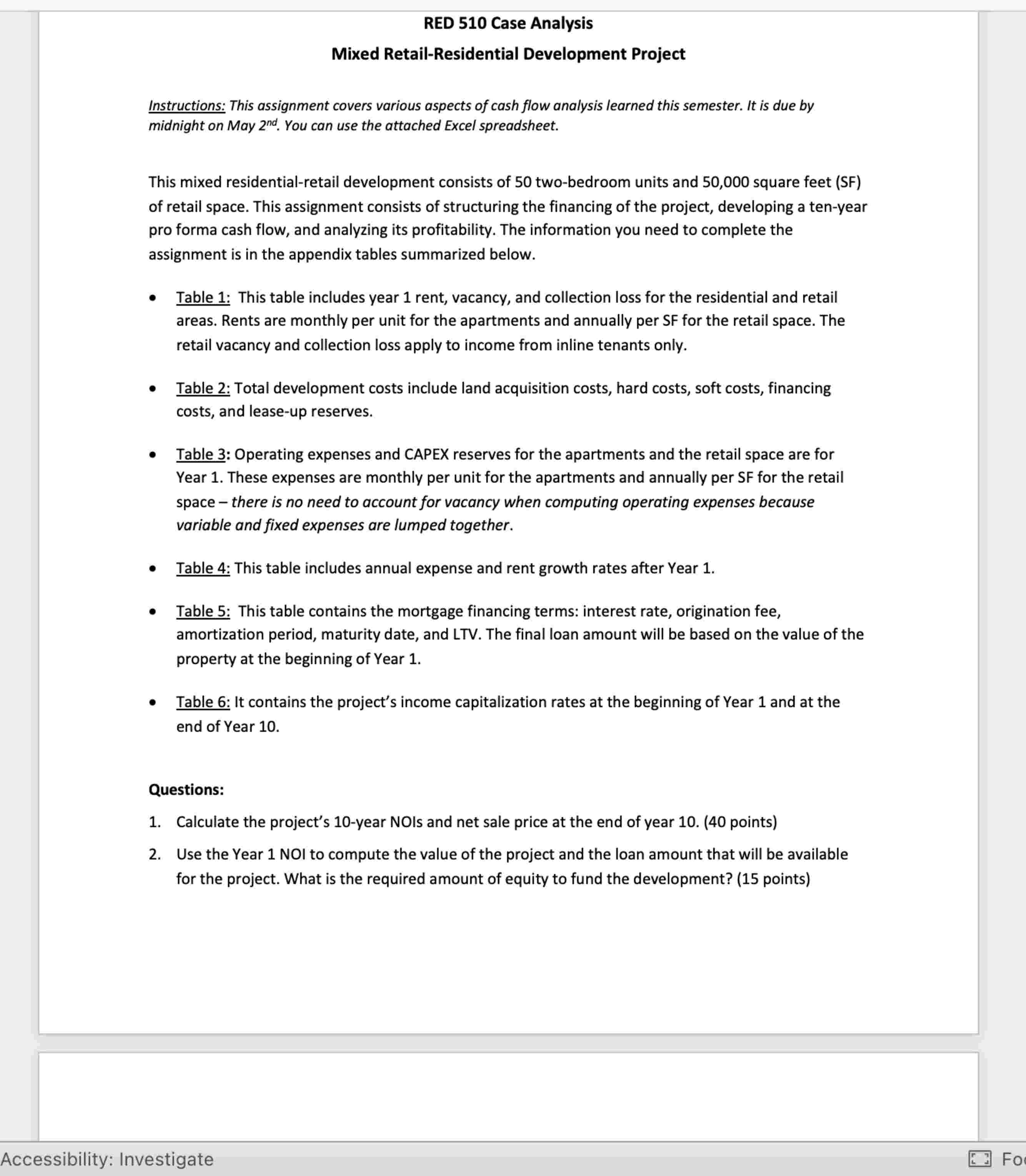

Question: 3 . Using the year 1 cash flow, compute the project's effective gross income multiplier ( EGIM ) , operating expense ratio ( OER )

Using the year cash flow, compute the project's effective gross income multiplier EGIM operating expense ratio OER debt coverage ratio DCR cashoncash COC return, and debt yield ratio DYR points

The project's annual beforetax operating cash flows and beforetax equity reversion at the end of year points

Compute the project's unlevered and levered NPV using the DCF method if the unlevered and levered discount rates are and respectively, under the assumption that the entire investment occurs instantaneously at the beginning of Year Should the developer go ahead with this project? Explain. points Appendix Tables:

Table : Year Income Assumptions

Table : Development Costs

Table : Operating Expenses in Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock