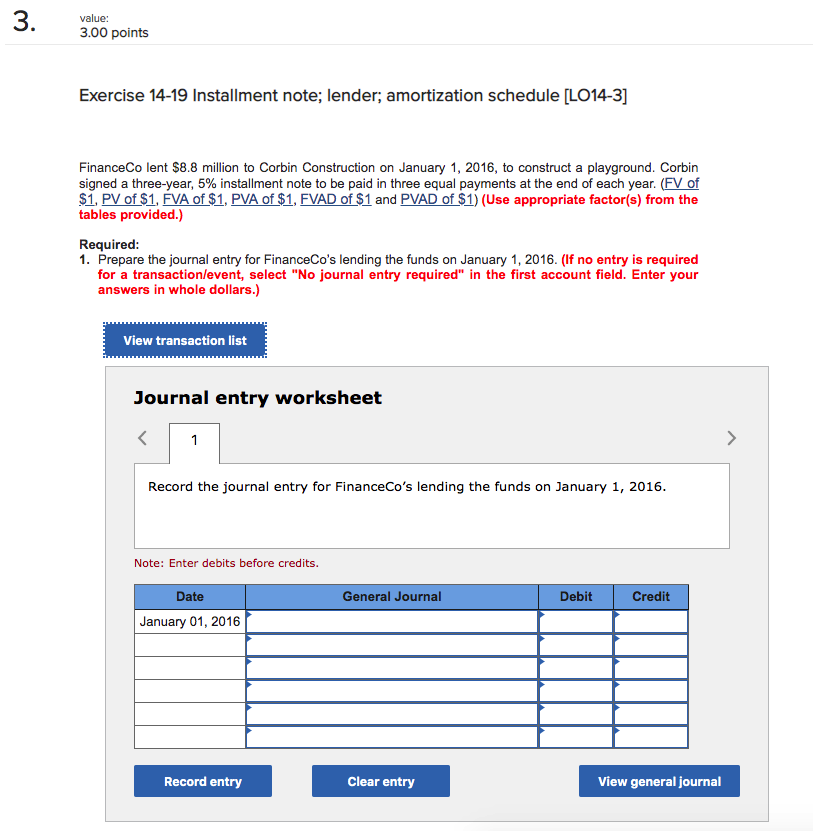

Question: 3. value: 3.00 points Exercise 14-19 Installment note; lender; amortization schedule [LO14-3] FinanceCo lent $8.8 million to Corbin Construction on January 1, 2016, to construct

![[LO14-3] FinanceCo lent $8.8 million to Corbin Construction on January 1, 2016,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e939cd96b9d_71766e939cd3bacd.jpg)

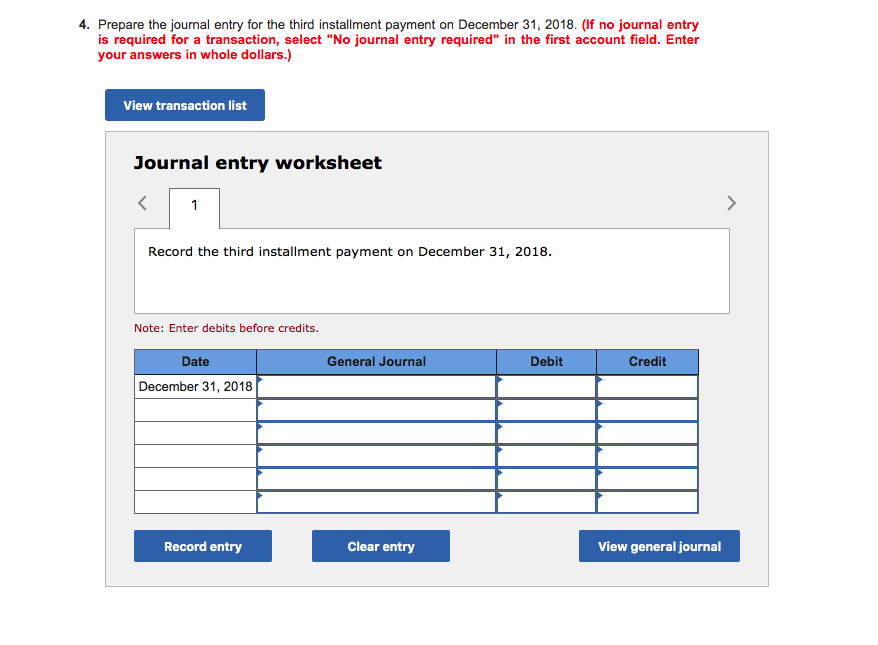

3. value: 3.00 points Exercise 14-19 Installment note; lender; amortization schedule [LO14-3] FinanceCo lent $8.8 million to Corbin Construction on January 1, 2016, to construct a playground. Corbin signed a three-year, 5% installment note to be paid in three equal payments at the end of each year. (FV of $1. PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entry for FinanceCo's lending the funds on January 1, 2016. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet > 1 Record the journal entry for FinanceCo's lending the funds on January 1, 2016. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2016 Record entry Clear entry View general journal 4. Prepare the jounal entry for the third installment payment on December 31, 2018. (If no journal entry is required for a transaction, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet 1 Record the third installment payment on December 31, 2018. Note: Enter debits before credits Date General Journal Debit Credit December 31, 2018 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts