Question: 3. value: 3.63 points Problem 15-34 Transfer Pricing with imperfect Markets: ROI Evaluation Normal Costing (LO 15-2) Oxford Company has two divisions. Thames Division, which

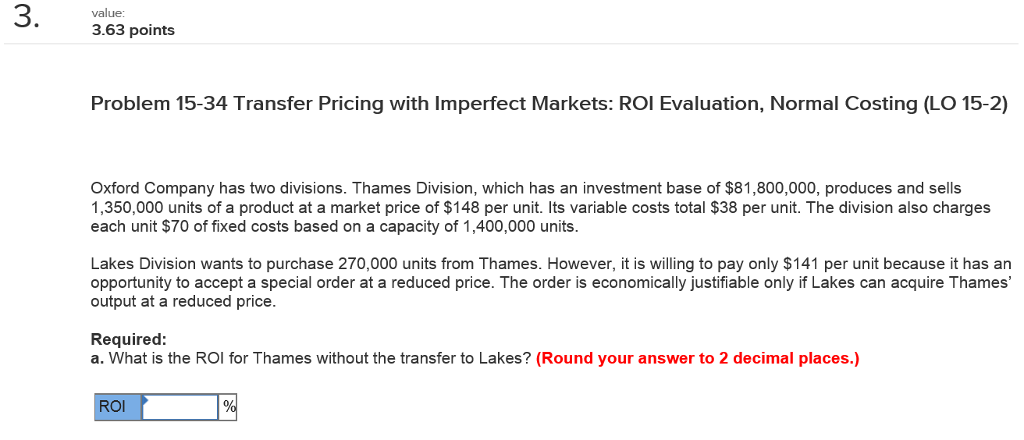

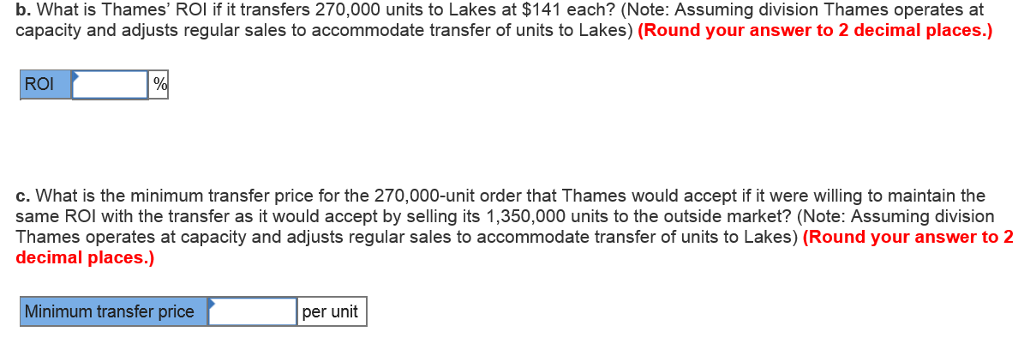

3. value: 3.63 points Problem 15-34 Transfer Pricing with imperfect Markets: ROI Evaluation Normal Costing (LO 15-2) Oxford Company has two divisions. Thames Division, which has an investment base of $81,800,000, produces and sells 1,350,000 units of a product at a market price of $148 per unit. Its variable costs total $38 per unit. The division also charges each unit $70 of fixed costs based on a capacity of 1,400,000 units Lakes Division wants to purchase 270,000 units from Thames. However, it is willing to pay only $141 per unit because it has an opportunity to accept a special order at a reduced price. The order is economically justifiable only if Lakes can acquire Thames' output at a reduced price. Required: a. What is the ROl for Thames without the transfer to Lakes? (Round your answer to 2 decimal places.) ROl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts