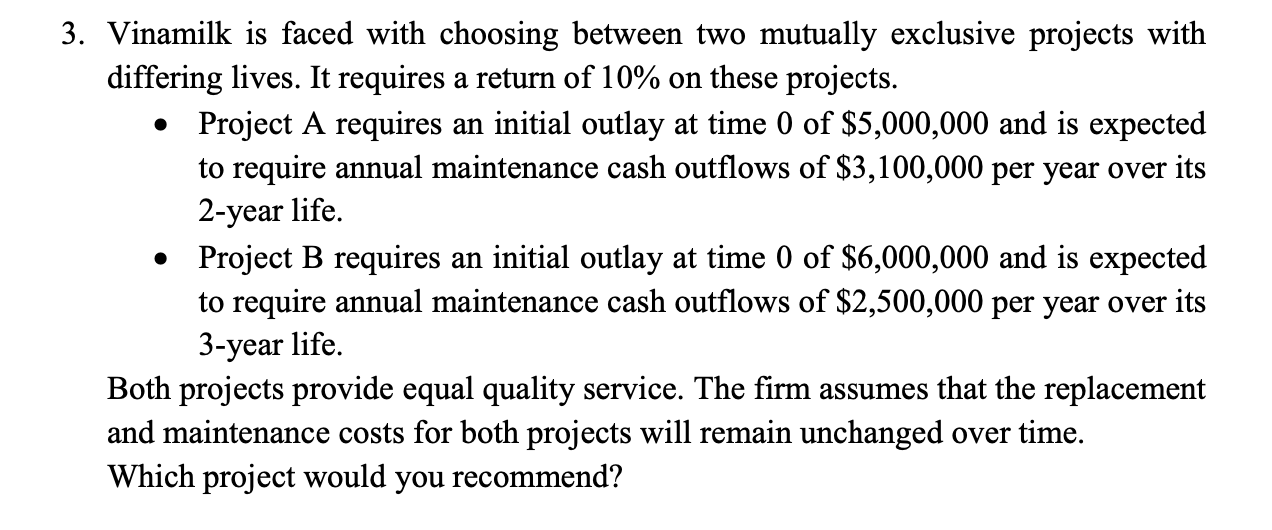

Question: 3. Vinamilk is faced with choosing between two mutually exclusive projects with differing lives. It requires a return of 10% on these projects. Project A

3. Vinamilk is faced with choosing between two mutually exclusive projects with differing lives. It requires a return of 10% on these projects. Project A requires an initial outlay at time 0 of $5,000,000 and is expected to require annual maintenance cash outflows of $3,100,000 per year over its 2-year life. Project B requires an initial outlay at time 0 of $6,000,000 and is expected to require annual maintenance cash outflows of $2,500,000 per year over its 3-year life. Both projects provide equal quality service. The firm assumes that the replacement and maintenance costs for both projects will remain unchanged over time. Which project would you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts