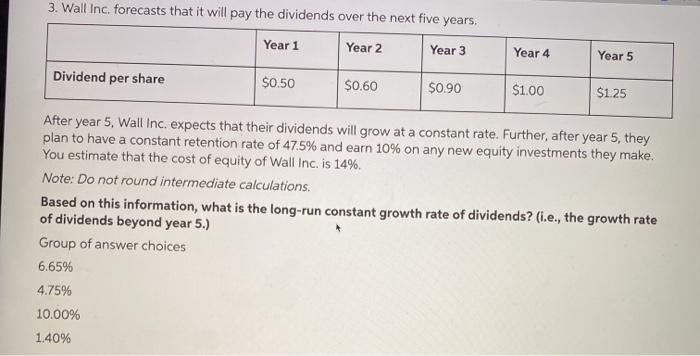

Question: 3. Wall Inc. forecasts that it will pay the dividends over the next five years. Year 1 Year 2 Year 3 Year 4 Year 5

3. Wall Inc. forecasts that it will pay the dividends over the next five years. Year 1 Year 2 Year 3 Year 4 Year 5 Dividend per share $0.50 $0.60 $0.90 $1.00 $1.25 After year 5, Wall Inc. expects that their dividends will grow at a constant rate. Further, after year 5, they plan to have a constant retention rate of 47.5% and earn 10% on any new equity investments they make. You estimate that the cost of equity of Wall Inc. is 14%. Note: Do not round intermediate calculations. Based on this information, what is the long-run constant growth rate of dividends? (i.e., the growth rate of dividends beyond year 5.) Group of answer choices 6.65% 4.75% 10.00% 1.40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts