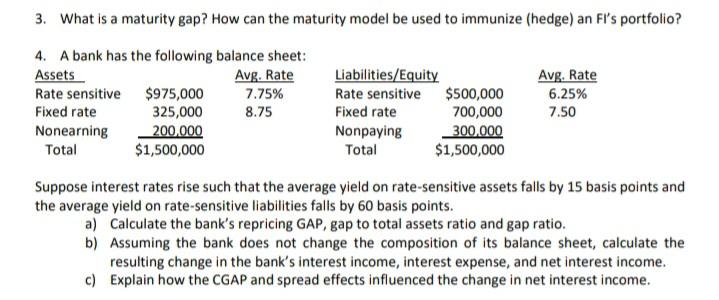

Question: 3. What is a maturity gap? How can the maturity model be used to immunize (hedge) an Fi's portfolio? 4. A bank has the following

3. What is a maturity gap? How can the maturity model be used to immunize (hedge) an Fi's portfolio? 4. A bank has the following balance sheet: Assets Avg. Rate Liabilities/Equity Avg. Rate Rate sensitive $975,000 7.75% Rate sensitive $500,000 6.25% Fixed rate 325,000 8.75 Fixed rate 700,000 7.50 Nonearning 200.000 Nonpaying 300.000 Total $1,500,000 Total $1,500,000 Suppose interest rates rise such that the average yield on rate-sensitive assets falls by 15 basis points and the average yield on rate-sensitive liabilities falls by 60 basis points. a) Calculate the bank's repricing GAP, gap to total assets ratio and gap ratio. b) Assuming the bank does not change the composition of its balance sheet, calculate the resulting change in the bank's interest income, interest expense, and net interest income. c) Explain how the CGAP and spread effects influenced the change in net interest income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts