Question: 3. What is the difference between current assess and long term liabilities what other information is needed to interpret these 4. What type of financial

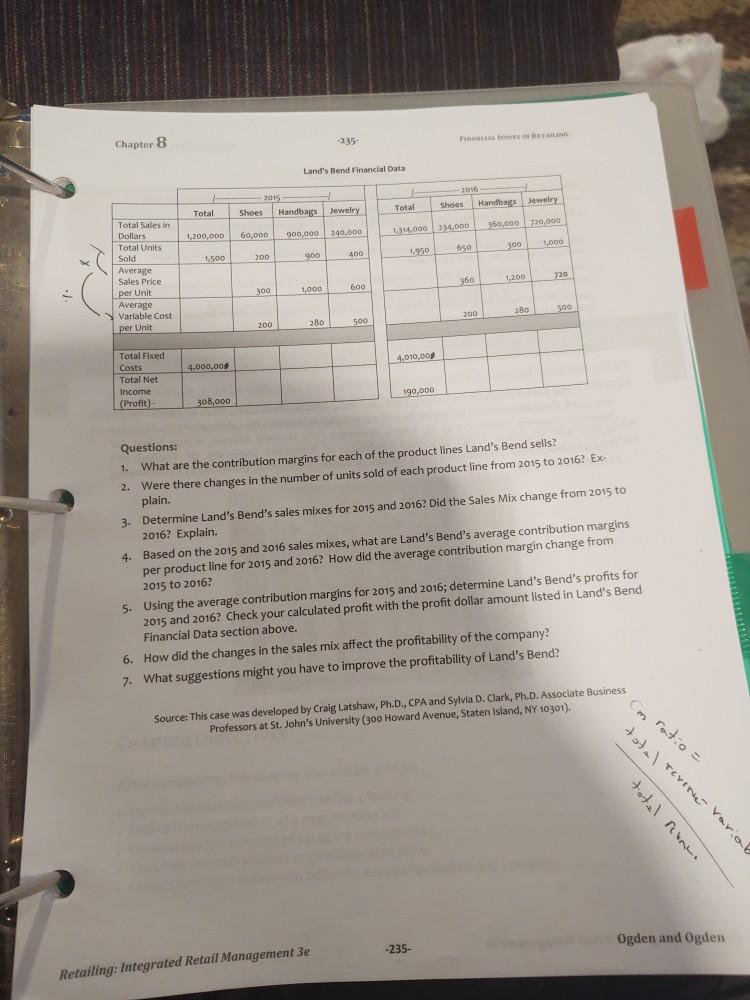

3. What is the difference between current assess and long term liabilities what other information is needed to interpret these 4. What type of financial information should be available to investors 5. What are the consequences for companies that cheat when reporting their financial status? Exercises 1. Public companies are required by United States tow to file required paperwork, go to the securi (www.sec.gov). On the website select the filling and forms section and do the following: thes and Exchange Commission's (SEC) EDGAR (Economic Data Gathering and Retrieval) website a. Complete the tutorial on EDGAR (https://www.sec.gov/edgar/quickedgar htm) b. Use EDGAR to find recent filings for two retailers of your choice. c. From the list of filings, choose a report for each of the retailers chosen in step b. d. In written form, summarize the data found for each retailer Analyze and report on the implica tions of the data you found 2. Select two retailers. Get their latest annual report. Look at their net profit margin. Are there any significant changes in the retailers' financial performance? Write down your results. Look at the key financial ratios for these retailers. Are they different or the same? Why are they different? Why are they alike? 3. Find a retailer who has committed financial fraud. Why do you think the retailer decided to de fraud their customers? What would you do differently? Why? 4. Select three retailers in the same industry. Calculate their quick ratio and then compare the three ratios. Are they different? Why? Why not? What do these ratios tell you about the retailers opera- tions: Case Land's Bend - Merchandising Mix and Profitability Land's Bend Company is a retail women's apparel company that specializes in high-end women's shoes, handbags and jewelry. The president of Land's Bend has come to you and is concerned about the profitability of the company. Some of the important changes occurring at Land's Bend from 2015 to 2016 were: 1. Land's Bend increased their sales prices on all their merchandise by 20% from 2015 to 2016. 2. Total units of merchandise sold increased by 30%. 3. The company's gross sales in dollars increased by almost 10%. 4. The unit costs to purchase the merchandise and total fixed costs remained relatively the same from 2015 to 2016 5. The company's profits dropped by 38% in 2016 The president has provided you with the following information concerning the last two years of operations. The president would like you to evaluate this information and see if you can determine a reason for this drop in profitability. Retailing: Integrated Retail Management 3e -234- Ogden and Ogden -235- FINANCIAL INSAN Chapter 8 Land's Bend Financial Data 3015 Shoes Handbags Jewelry 2016 Shoes Handbags Jewelry Total Total 360,000 720,000 1,200,000 60,000 900,000 1.114.000 234.000 240.000 300 1000 650 1950 400 200 1,500 900 Total Sales in Dollars Total Units Sold Average Sales Price per Unit Average Variable Cost 200 720 360 300 1,000 600 500 280 200 200 280 500 per Unit 4.010,000 4.000,00 Total Fixed Costs Total Net Income (Profit) 190,000 308,000 Questions: 1. What are the contribution margins for each of the product lines Land's Bend sells? 2. Were there changes in the number of units sold of each product line from 2015 to 2016? Ex- plain. 3. Determine Land's Bend's sales mixes for 2015 and 2016? Did the Sales Mix change from 2015 to 2016? Explain. 4. Based on the 2015 and 2016 sales mixes, what are Land's Bend's average contribution margins per product line for 2015 and 2016? How did the average contribution margin change from 2015 to 2016? 5. Using the average contribution margins for 2015 and 2016; determine Land's Bend's profits for 2015 and 2016? Check your calculated profit with the profit dollar amount listed in Land's Bend Financial Data section above. 6. How did the changes in the sales mix affect the profitability of the company 7. What suggestions might you have to improve the profitability of Land's Bend? Source: This case was developed by Craig Latshaw, Ph.D., CPA and Sylvia D. Clark, Ph.D. Associate Business Professors at St. John's University (300 Howard Avenue, Staten Island, NY 10301). total revenu varal total rene. Ogden and Ogden -235- Retailing: Integrated Retail Management 3e

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock