Question: 3. What position is equivalent to a long forward contract to buy an asset at K on a certain date and a put option on

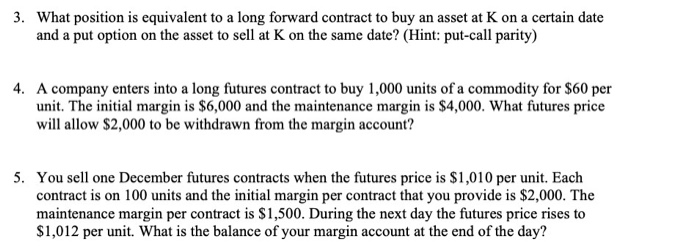

3. What position is equivalent to a long forward contract to buy an asset at K on a certain date and a put option on the asset to sell at K on the same date? (Hint: put-call parity) 4. A company enters into a long futures contract to buy 1,000 units of a commodity for $60 per unit. The initial margin is $6,000 and the maintenance margin is $4,000. What futures price will allow $2,000 to be withdrawn from the margin account? 5. You sell one December futures contracts when the futures price is $1,010 per unit. Each contract is on 100 units and the initial margin per contract that you provide is $2,000. The maintenance margin per contract is $1,500. During the next day the futures price rises to $1,012 per unit. What is the balance of your margin account at the end of the day

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts