Question: 3. Within-firm risk and beta risk Understanding risks that affect projects and the impact of risk consideration Yatta Net International has manufacturing, distribution, retail, and

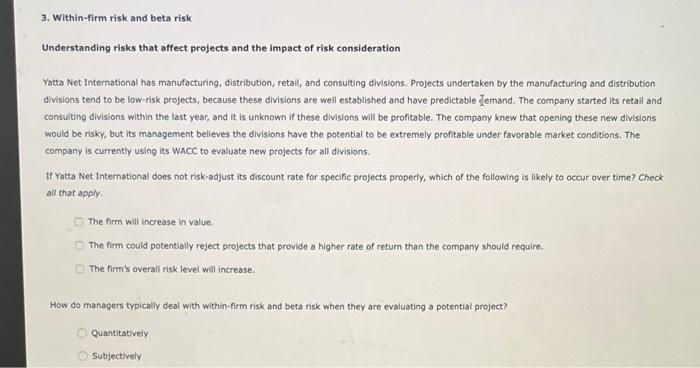

3. Within-firm risk and beta risk Understanding risks that affect projects and the impact of risk consideration Yatta Net International has manufacturing, distribution, retail, and consulting divisions. Projects undertaken by the manufacturing and distribution divisions tend to be low-risk projects, because these divisions are well established and have predictable dernand. The company started its retail and consulting divisions within the last year, and it is unknown if these divisions will be profitable. The company knew that opening these new divisions would be risky, but its management believes the divisions have the potential to be extremely profitable under favorable market conditions. The company is currently using its wacC to evaluate new projects for all divisions. If Yatta Net International does not risk-adjust its discount rate for speciic projects properly, which of the following is likely to occur over time? Check all that apply. The firm will increase in value. The firm could potentially reject projects that provide a higher rate of return than the company should require. The firm's overall risk level will increase. How do managers typically deal with within-firm risk and beta risk when they are evaluating a potential project? Quantitatively Subjectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts