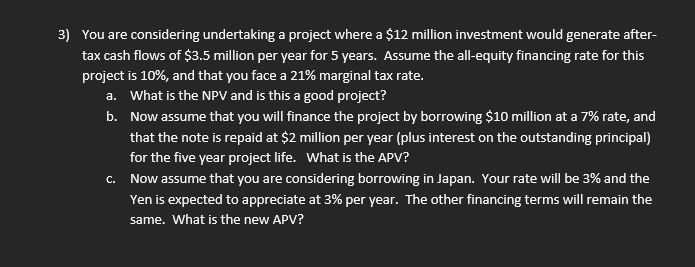

Question: 3) You are considering undertaking a project where a $12 million investment would generate aftertax cash flows of $3.5 million per year for 5 years.

3) You are considering undertaking a project where a \$12 million investment would generate aftertax cash flows of \$3.5 million per year for 5 years. Assume the all-equity financing rate for this project is 10%, and that you face a 21% marginal tax rate. a. What is the NPV and is this a good project? b. Now assume that you will finance the project by borrowing $10 million at a 7% rate, and that the note is repaid at $2 million per year (plus interest on the outstanding principal) for the five year project life. What is the APV? c. Now assume that you are considering borrowing in Japan. Your rate will be 3% and the Yen is expected to appreciate at 3% per year. The other financing terms will remain the same. What is the new APV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts