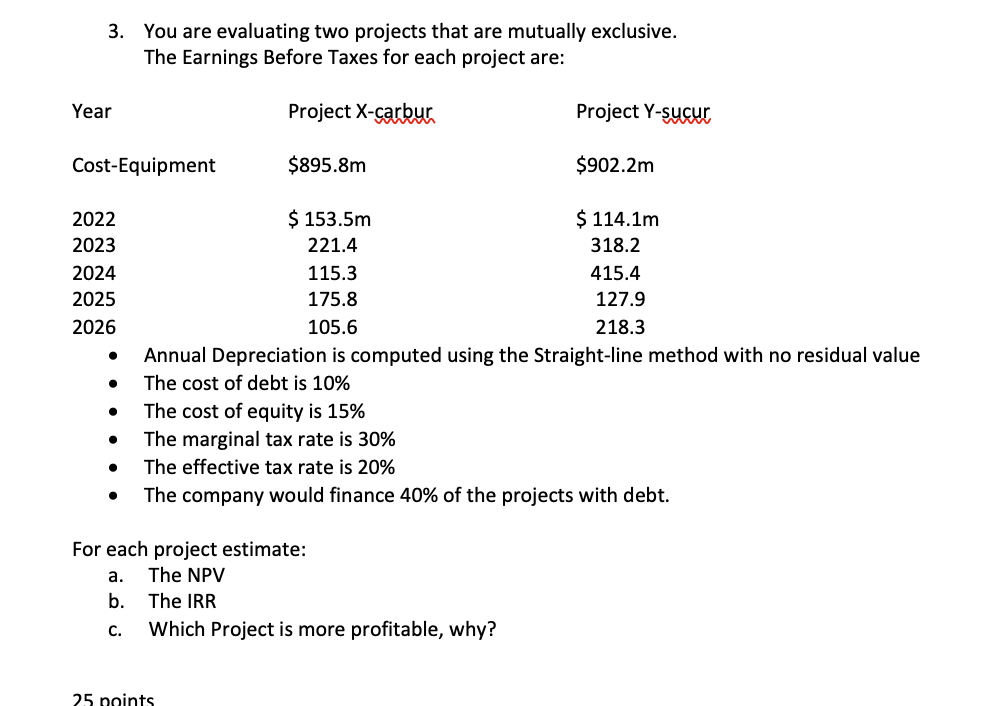

Question: 3. You are evaluating two projects that are mutually exclusive. The Earnings Before Taxes for each project are: Year Project X-carbur Project Y-sucur Cost-Equipment $895.8m

3. You are evaluating two projects that are mutually exclusive. The Earnings Before Taxes for each project are: Year Project X-carbur Project Y-sucur Cost-Equipment $895.8m $902.2m 2022 $ 153.5m $ 114.1m 2023 221.4 318.2 2024 115.3 415.4 2025 175.8 127.9 2026 105.6 218.3 Annual Depreciation is computed using the Straight-line method with no residual value The cost of debt is 10% The cost of equity is 15% The marginal tax rate is 30% The effective tax rate is 20% The company would finance 40% of the projects with debt. For each project estimate: a. The NPV b. The IRR C. Which Project is more profitable, why? 25 points 3. You are evaluating two projects that are mutually exclusive. The Earnings Before Taxes for each project are: Year Project X-carbur Project Y-sucur Cost-Equipment $895.8m $902.2m 2022 $ 153.5m $ 114.1m 2023 221.4 318.2 2024 115.3 415.4 2025 175.8 127.9 2026 105.6 218.3 Annual Depreciation is computed using the Straight-line method with no residual value The cost of debt is 10% The cost of equity is 15% The marginal tax rate is 30% The effective tax rate is 20% The company would finance 40% of the projects with debt. For each project estimate: a. The NPV b. The IRR C. Which Project is more profitable, why? 25 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts