Question: 3. You probably noticed that we had to make some assumptions about the future in order to arrive at a decision on whether to purchase

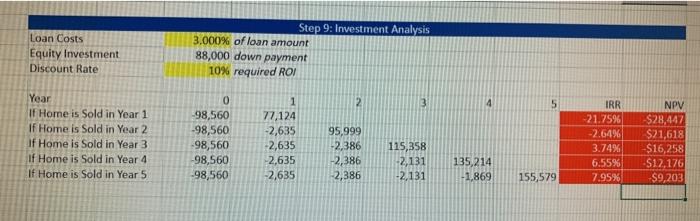

3. You probably noticed that we had to make some assumptions about the future in order to arrive at a decision on whether to purchase a home. I now want you to determine how the IRRs and NPVs change if the following assumptions change. In other words, I want you to plug in new values into your spreadsheet and then tell me if/how your decision to own changes. a. Suppose that property values/rents grow by less than you forecasted. For example, suppose that growth is 0% (no growth). b. Suppose that maintenance costs are greater than you expected, such as if the house has problems that you did not anticipate or if the house needs to be significantly remodeled. For example, suppose that maintenance costs are double the percentage that you projected. c. Suppose that you change the mortgage that you selected. For example, if you selected the 30-year mortgage, suppose that you instead chose the 15-year mortgage. Loan Costs Equity Investment Discount Rate Step 9: Investment Analysis 3.000% of loan amount 88,000 down payment 10% required ROI 2 3 4 5 Year If Home is Sold in Year 1 If Home is sold in Year 2 If Home is Sold in Year 3 If Home is Sold in Year 4 If Home is Sold in Year 5 0 -98,560 -98,560 -98,560 -98,560 -98,560 1 77,124 -2,635 -2,635 2,635 -2,635 95,999 -2,386 -2,386 -2,386 IRR -21.7596 -2.64% 3.74% 6:55% 7.95% 115,358 -2,131 -2,131 NPV -$28,447 $21,618 $16,258 -S12,176 $9,203 135,214 -1,869 155,579 3. You probably noticed that we had to make some assumptions about the future in order to arrive at a decision on whether to purchase a home. I now want you to determine how the IRRs and NPVs change if the following assumptions change. In other words, I want you to plug in new values into your spreadsheet and then tell me if/how your decision to own changes. a. Suppose that property values/rents grow by less than you forecasted. For example, suppose that growth is 0% (no growth). b. Suppose that maintenance costs are greater than you expected, such as if the house has problems that you did not anticipate or if the house needs to be significantly remodeled. For example, suppose that maintenance costs are double the percentage that you projected. c. Suppose that you change the mortgage that you selected. For example, if you selected the 30-year mortgage, suppose that you instead chose the 15-year mortgage. Loan Costs Equity Investment Discount Rate Step 9: Investment Analysis 3.000% of loan amount 88,000 down payment 10% required ROI 2 3 4 5 Year If Home is Sold in Year 1 If Home is sold in Year 2 If Home is Sold in Year 3 If Home is Sold in Year 4 If Home is Sold in Year 5 0 -98,560 -98,560 -98,560 -98,560 -98,560 1 77,124 -2,635 -2,635 2,635 -2,635 95,999 -2,386 -2,386 -2,386 IRR -21.7596 -2.64% 3.74% 6:55% 7.95% 115,358 -2,131 -2,131 NPV -$28,447 $21,618 $16,258 -S12,176 $9,203 135,214 -1,869 155,579

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts