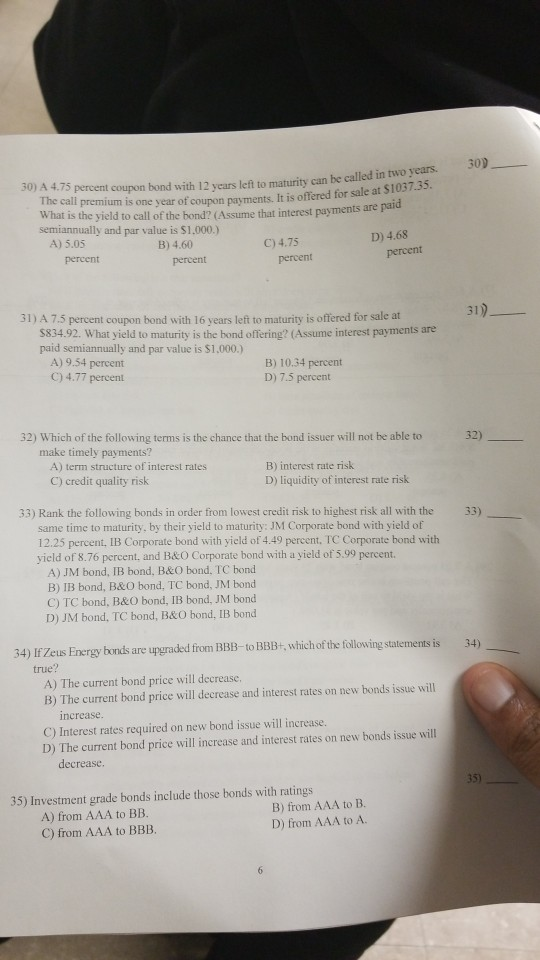

Question: 30) 2 years left to maturity can be called in two years. of coupon payments. It is offered for sale at $1037.35. 30) A 4.75

30) 2 years left to maturity can be called in two years. of coupon payments. It is offered for sale at $1037.35. 30) A 4.75 percent coupon bond with 1 The call premium is one year It iso What is the yield to call of the bond? (Assume that interest payments are semiannually and par value is $1,000.) A) 5.05 C)4.75 D) 4.68 B) 4.60 percent percent percent percent 31) A 7.5 percent coupon bond with 16 years left to maturity is offered for sale at 31 $834.92. What yield to maturity is the bond offering? (Assume interest payments are paid semiannually and par value is $1,000.) A) 9.54 percent C)4.77 percent B) 10.34 percent D) 7.5 percent 32) Which of the following terms is the chance that the bond issuer will not be able to make timely payments? 4) term structure of interest rates C) credit quality risk B) interest rate risk D) liquidity of interest rate risk 33) Rank the following bonds in order from lowest credit risk to highest risk all with the 33) same time to maturity, by their yield to maturity: JM Corporate bond with yield of 12.25 percent. IB Corporate bond with yield of 4.49 percent, TC Corporate hond with yield of 8.76 percent, and B&O Corporate bond with a yield of 5.99 percent. A) JM bond, IB bond, B&O bond, TC bond B) IB bond, B&O bond, TC bond, JM bond C) TC bond, B&0 bond, IB bond, JM bond D) JM bond, TC bond, B&O bond, IB bond 34) If Zeus Energy bonds are upgraded from BBB-to BBB+, whichof the following s statements is34) true? A) The current bond price will decrease. B) The current bond price will decrease and interest rates on new bonds issue will ncrease C) Interest rates required on new bond issue will increase. D) The current bond price will increase and interest rates on new bonds issue will decrease 35) 35) Investment grade bonds include those bonds with ratings A) from AAA to BB. C) from AAA to BBB B) from AAA to B. D) from AAA to A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts