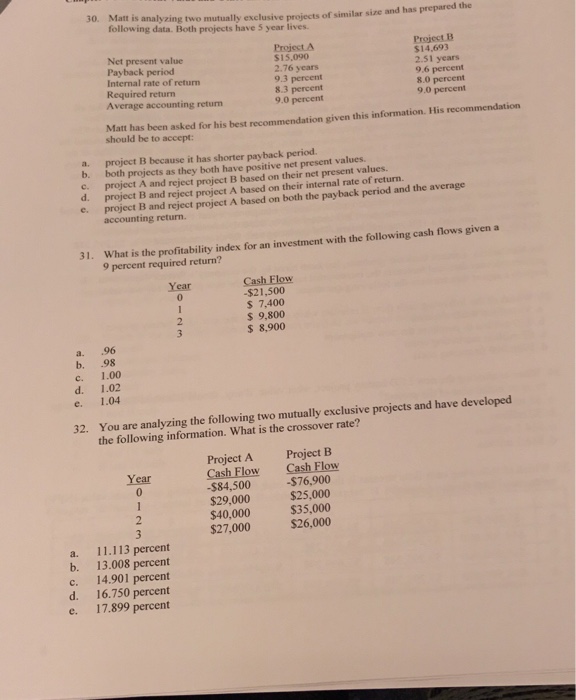

Question: 30 31 32 Matt is analyzing two mutually exclusive projects of similar size and has prepared the following data. Both projects have 5 year lives.

30 31 32

30 31 32 Matt is analyzing two mutually exclusive projects of similar size and has prepared the following data. Both projects have 5 year lives. Matt has been asked for his best recommendation given this information. His recommendation should be accept: a. project B because it has shorter payback period. b. both projects as they both have positive net present values. c. project A and reject project B based on their net present of return. d. Project B and the project A based on their internal rate or return. e. project B and reject project A based on both the payback period and the average accounting return. What is the profitability index for an investment with the following cash flows given a 9 percent required return? a. .96 b. .98 c. 1.00 d. 1.02 e. 1.04 You are analyzing the following two mutually exclusive projects and have developed the following information. What is the crossover rate? a. 11.113 percent b. 13.008 percent c. 14.901 percent d. 16.750 percent e. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts