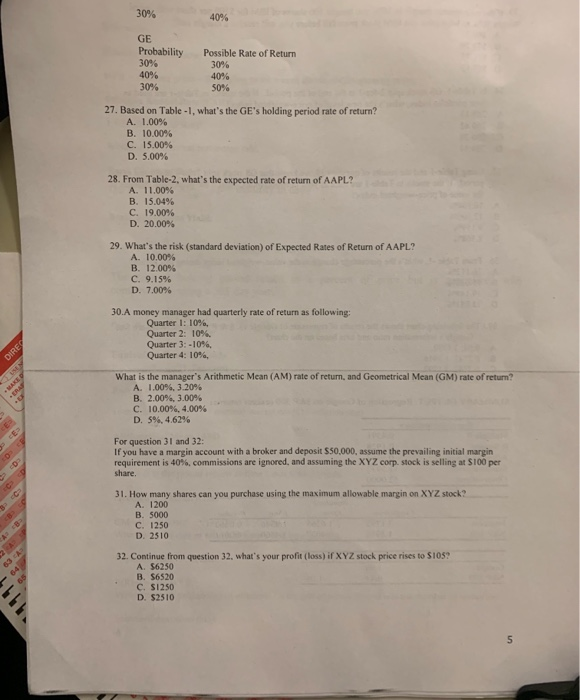

Question: 30% 50% 27. Based on Table - I, what's the GE's holding period rate of return? A. 1.00% B. 10.00% C. 15.00% D. 5.00% 28.

30% 50% 27. Based on Table - I, what's the GE's holding period rate of return? A. 1.00% B. 10.00% C. 15.00% D. 5.00% 28. From Table-2, what's the expected rate of return of AAPL? A. 11.00% B. 15.04% C. 19.00% D. 20.00% 29. What's the risk (standard deviation) of Expected Rates of Return of AAPL? A. 10.00% B. 12.00% C. 9.15% D. 7.00% 30.A money manager had quarterly rate of return as following: Quarter 1: 10% Quarter 2: 10% Quarter 3: -10% Quarter 4: 10%. DIRET What is the manager's Arithmetic Mean (AM) rate of return, and Geometrical Mean (GM) rate of return? A. 1.00%.3.20% B. 2.00% 3.00% C. 10.00%, 4.00% D. 5%, 4.62% For question 31 and 32: If you have a margin account with a broker and deposit $50.000, assume the prevailing initial margin requirement is 40%, commissions are ignored, and assuming the XYZ corp. stock is selling at $100 per share. 31. How many shares can you purchase using the maximum allowable margin on XYZ stock? A. 1200 B. 5000 C. 1250 D. 2510 63 32. Continue from question 32, what's your profit (loss) if XYZ stock price rises to S105? A. $6250 B. $6520 C. S1250 D. $2510 30% GE Probability 30% 40% 30% Possible Rate of Return 30% 40% 50% 27. Based on Table - I, what's the GE's holding period rate of return? A. 1.00% B. 10.00% C. 15.00% D. 5.00% 28. From Table-2, what's the expected rate of return of AAPL? A. 11.00% B. 15.04% C. 19.00% D. 20.00% 29. What's the risk (standard deviation) of Expected Rates of Return of AAPL? A 10.00 B. 12.0096 C. 9.15% D. 7.00% 30.A money manager had quarterly rate of return as following: Quarter 1: 10% Quarter 2: 10% Quarter 3: -10% Quarter 4: 10% DIRES What is the manager's Arithmetic Mean (AM) rate of return, and Geometrical Mean (GM) rate of return? A. 1.00% 3.20% B 2.00%, 3.00% C. 10.00%, 4.00% D. 5%, 4.62% For question 31 and 32: If you have a margin account with a broker and deposit $50,000, assume the prevailing initial margin requirement is 40%, commissions are ignored, and assuming the XYZ corp. stock is selling at $100 per share. 31. How many shares can you purchase using the maximum allowable margin on XYZ stock? A 1200 B. 5000 C 1250 D. 2510 32. Continue from question 32, what's your profit (loss) ir XYZ stock price rises to S105 A 56250 B. $6520 CSI250 D. $2510 30% 50% 27. Based on Table - I, what's the GE's holding period rate of return? A. 1.00% B. 10.00% C. 15.00% D. 5.00% 28. From Table-2, what's the expected rate of return of AAPL? A. 11.00% B. 15.04% C. 19.00% D. 20.00% 29. What's the risk (standard deviation) of Expected Rates of Return of AAPL? A. 10.00% B. 12.00% C. 9.15% D. 7.00% 30.A money manager had quarterly rate of return as following: Quarter 1: 10% Quarter 2: 10% Quarter 3: -10% Quarter 4: 10%. DIRET What is the manager's Arithmetic Mean (AM) rate of return, and Geometrical Mean (GM) rate of return? A. 1.00%.3.20% B. 2.00% 3.00% C. 10.00%, 4.00% D. 5%, 4.62% For question 31 and 32: If you have a margin account with a broker and deposit $50.000, assume the prevailing initial margin requirement is 40%, commissions are ignored, and assuming the XYZ corp. stock is selling at $100 per share. 31. How many shares can you purchase using the maximum allowable margin on XYZ stock? A. 1200 B. 5000 C. 1250 D. 2510 63 32. Continue from question 32, what's your profit (loss) if XYZ stock price rises to S105? A. $6250 B. $6520 C. S1250 D. $2510 30% GE Probability 30% 40% 30% Possible Rate of Return 30% 40% 50% 27. Based on Table - I, what's the GE's holding period rate of return? A. 1.00% B. 10.00% C. 15.00% D. 5.00% 28. From Table-2, what's the expected rate of return of AAPL? A. 11.00% B. 15.04% C. 19.00% D. 20.00% 29. What's the risk (standard deviation) of Expected Rates of Return of AAPL? A 10.00 B. 12.0096 C. 9.15% D. 7.00% 30.A money manager had quarterly rate of return as following: Quarter 1: 10% Quarter 2: 10% Quarter 3: -10% Quarter 4: 10% DIRES What is the manager's Arithmetic Mean (AM) rate of return, and Geometrical Mean (GM) rate of return? A. 1.00% 3.20% B 2.00%, 3.00% C. 10.00%, 4.00% D. 5%, 4.62% For question 31 and 32: If you have a margin account with a broker and deposit $50,000, assume the prevailing initial margin requirement is 40%, commissions are ignored, and assuming the XYZ corp. stock is selling at $100 per share. 31. How many shares can you purchase using the maximum allowable margin on XYZ stock? A 1200 B. 5000 C 1250 D. 2510 32. Continue from question 32, what's your profit (loss) ir XYZ stock price rises to S105 A 56250 B. $6520 CSI250 D. $2510

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts