30. Adam Smith is considering automating his pin factory with the purchase of a $475,000 machine....

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

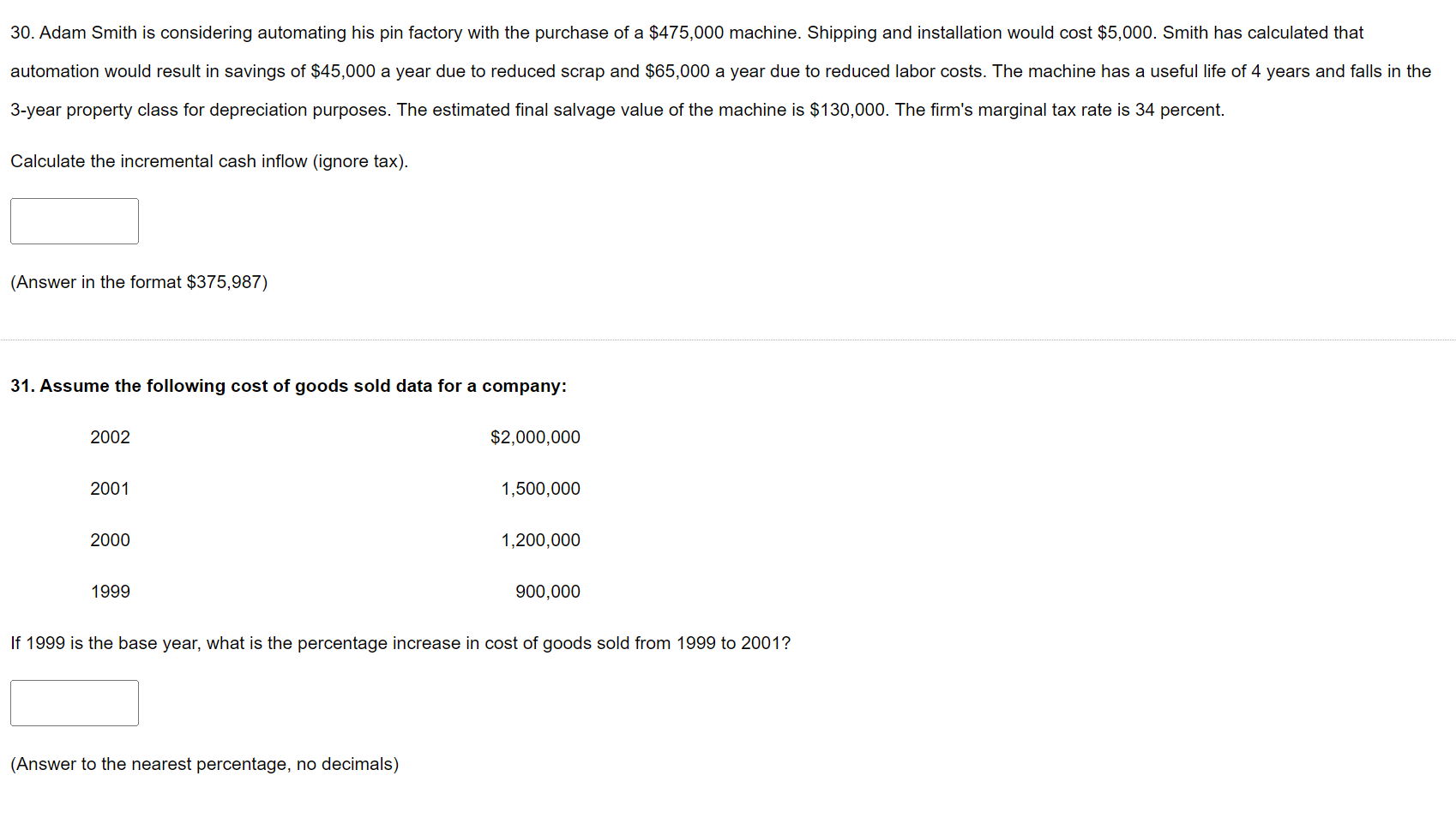

30. Adam Smith is considering automating his pin factory with the purchase of a $475,000 machine. Shipping and installation would cost $5,000. Smith has calculated that automation would result in savings of $45,000 a year due to reduced scrap and $65,000 a year due to reduced labor costs. The machine has a useful life of 4 years and falls in the 3-year property class for depreciation purposes. The estimated final salvage value of the machine is $130,000. The firm's marginal tax rate is 34 percent. Calculate the incremental cash inflow (ignore tax). (Answer in the format $375,987) 31. Assume the following cost of goods sold data for a company: 2002 2001 2000 1999 $2,000,000 1,500,000 1,200,000 900,000 If 1999 is the base year, what is the percentage increase in cost of goods sold from 1999 to 2001? (Answer to the nearest percentage, no decimals) 30. Adam Smith is considering automating his pin factory with the purchase of a $475,000 machine. Shipping and installation would cost $5,000. Smith has calculated that automation would result in savings of $45,000 a year due to reduced scrap and $65,000 a year due to reduced labor costs. The machine has a useful life of 4 years and falls in the 3-year property class for depreciation purposes. The estimated final salvage value of the machine is $130,000. The firm's marginal tax rate is 34 percent. Calculate the incremental cash inflow (ignore tax). (Answer in the format $375,987) 31. Assume the following cost of goods sold data for a company: 2002 2001 2000 1999 $2,000,000 1,500,000 1,200,000 900,000 If 1999 is the base year, what is the percentage increase in cost of goods sold from 1999 to 2001? (Answer to the nearest percentage, no decimals)

Expert Answer:

Posted Date:

Students also viewed these finance questions

-

You bought one of Great White Shark Repellant Co.'s 5.1 percent coupon bonds one year ago for $1,010. These bonds have a par value of $1,000, make annual payments, and mature 14 years from now....

-

The Fresno Finial Fabricating Works is considering automating its existing finial casting and assembly department. The plant manager, Mel Content, has accumulated the following information for you: ...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

XYZ purchased an equipment worth of $150,000 including insurance cost $30,000 and duty cost $20,000 on May 15, 2018. They have decided to capitalize the $35,000 installation charge instead of $20,000...

-

The Lillie Rubin boutique in Phoenix would hire only women to work in sales because fittings and alterations took place in the dressing room or immediately outside. The customers were buying...

-

Explain briefly the three concepts that have replaced the concept of title. When do title and risk of loss shift under an F.O.B. seller contract and under an F.O.B. buyer contract?

-

If Skechers sells goods to Target with terms FOB shipping point, which company reports these goods in its inventory while they are in transit?

-

Biofuel Inc. (BI) is a private company that just started up this year. The company's owner, Sarah Biorini, created a process whereby carbon dioxide (CO,) emissions are converted into biofuel....

-

Evaluate the indefinite integral by using the given substitution to reduce the integral to standard form. 18r dr u=4-1 =4-19

-

Prepare a common sized income statement and balance sheet for the most recently reported fiscal year.( for Nordstorm Inc.) for the last three year. Income Statement All numbers in thousands Revenue...

-

There is evidence to suggest that human beings are not very good random number generators. In this activity, you will investigate this phenomenon by collecting and analyzing a set of human-generated...

-

Derive the integrals necessary for departure functions for U, G, and A for an equation of state written in terms of Z = f (T,P) using the integrals provided for H and S in Section 8.6. P H-Hig (FRF)...

-

This activity requires the use of a statistical computer package capable of fitting multiple regression models. Background: The given data on y, x 1 , x 2 , x 3 , and x 4 were generated using a...

-

(a) Fit the Margules two-parameter equation to the methanol(1) + benzene(2) system P-x-y data below at 90C (Jost, W., Roek, H, Schroeder, W., Sieg, L., Wagner, H.G. 1957. Z. Phys. Chem. 10:133) by...

-

Consider a mediocre basketball player who has consistently made only 50% of his free throws over several seasons. If we were to examine his free throw record over the last 50 free throw attempts, is...

-

XS Supply Company is developing its annual financial statements at December 31. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income...

-

What is a make-or-buy decision?

-

The United States is the largest producer of corn in the world. Each year, a corn farmer must decide what type of seed to use and what the end market for the corn crop will be. In approximately a...

-

Why do buyers involved in straight rebuy purchases require less information than those making new-task purchases?

-

Why might business customers generally be considered more rational in their purchasing behavior than ultimate consumers?

Study smarter with the SolutionInn App