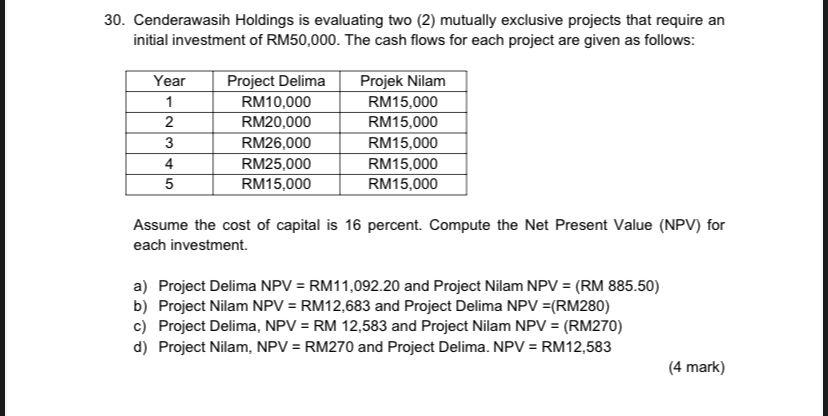

Question: 30. Cenderawasih Holdings is evaluating two (2) mutually exclusive projects that require an initial investment of RM50,000. The cash flows for each project are given

30. Cenderawasih Holdings is evaluating two (2) mutually exclusive projects that require an initial investment of RM50,000. The cash flows for each project are given as follows: Year 1 2 3 4 5 Project Delima RM10,000 RM20,000 RM26.000 RM25,000 RM15,000 Projek Nilam RM15,000 RM15,000 RM15,000 RM15,000 RM15,000 Assume the cost of capital is 16 percent. Compute the Net Present Value (NPV) for each investment. a) Project Delima NPV = RM11,092.20 and Project Nilam NPV = (RM 885.50) b) Project Nilam NPV = RM12,683 and Project Delima NPV =(RM280) c) Project Delima, NPV = RM 12,583 and Project Nilam NPV = (RM270) d) Project Nilam, NPV = RM270 and Project Delima. NPV = RM12,583 (4 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts