Question: 30) Long-lived assets are: A) non-operating assets expected to yield their economic benefits (or service potential) over a period longer than one year. B) operating

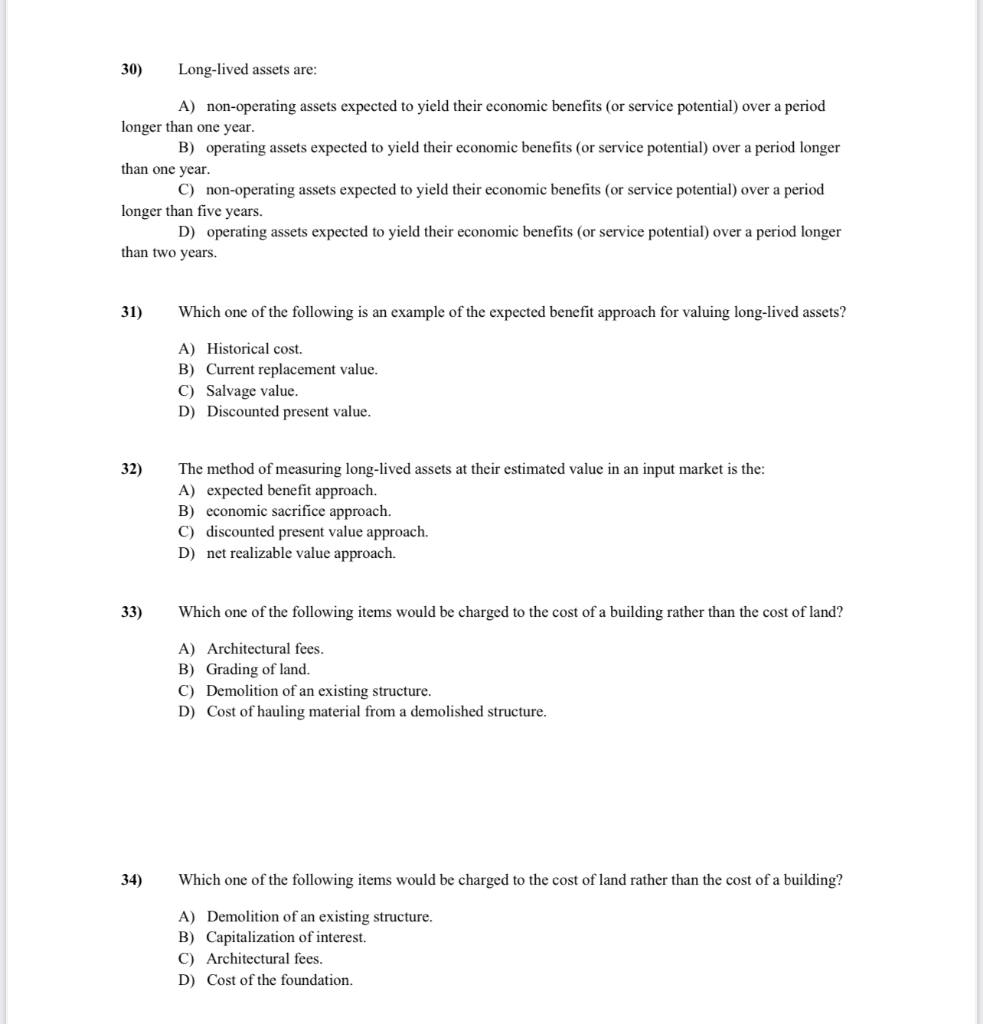

30) Long-lived assets are: A) non-operating assets expected to yield their economic benefits (or service potential) over a period longer than one year. B) operating assets expected to yield their economic benefits (or service potential) over a period longer than one year. C) non-operating assets expected to yield their economic benefits (or service potential) over a period longer than five years. D) operating assets expected to yield their economic benefits (or service potential) over a period longer than two years. 31) Which one of the following is an example of the expected benefit approach for valuing long-lived assets? A) Historical cost. B) Current replacement value. C) Salvage value. D) Discounted present value. 32) The method of measuring long-lived assets at their estimated value in an input market is the: A) expected benefit approach. B) economic sacrifice approach. C) discounted present value approach. D) net realizable value approach. 33) Which one of the following items would be charged to the cost of a building rather than the cost of land? A) Architectural fees. B) Grading of land. C) Demolition of an existing structure. D) Cost of hauling material from a demolished structure. 34) Which one of the following items would be charged to the cost of land rather than the cost of a building? A) Demolition of an existing structure. B) Capitalization of interest. C) Architectural fees. D) Cost of the foundation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts