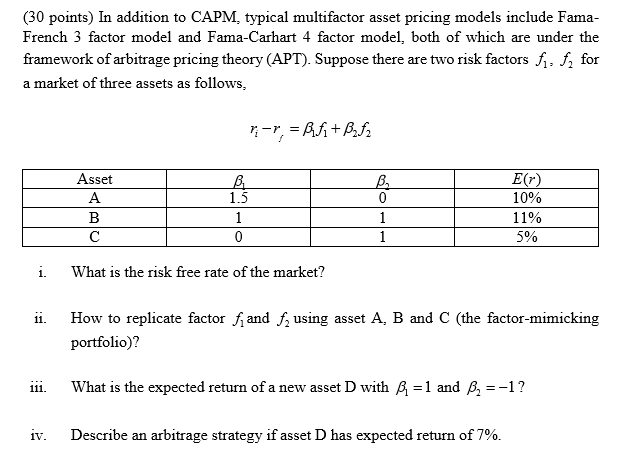

Question: (30 points) In addition to CAPM. typical multifactor asset pricing models include Fama- French 3 factor model and Fama-Carhart 4 factor model, both of which

(30 points) In addition to CAPM. typical multifactor asset pricing models include Fama- French 3 factor model and Fama-Carhart 4 factor model, both of which are under the framework of arbitrage pricing theory (APT). Suppose there are two risk factors fi. f, for a market of three assets as follows, r-r = Bfi+Bf2 Asset A E() 10% 11% 5% B i. What is the risk free rate of the market? How to replicate factor fi and f, using asset A, B and C (the factor-mimicking portfolio)? 111. What is the expected return of a new asset D with B = 1 and B =-1? iv. Describe an arbitrage strategy if asset D has expected return of 7%. (30 points) In addition to CAPM. typical multifactor asset pricing models include Fama- French 3 factor model and Fama-Carhart 4 factor model, both of which are under the framework of arbitrage pricing theory (APT). Suppose there are two risk factors fi. f, for a market of three assets as follows, r-r = Bfi+Bf2 Asset A E() 10% 11% 5% B i. What is the risk free rate of the market? How to replicate factor fi and f, using asset A, B and C (the factor-mimicking portfolio)? 111. What is the expected return of a new asset D with B = 1 and B =-1? iv. Describe an arbitrage strategy if asset D has expected return of 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts