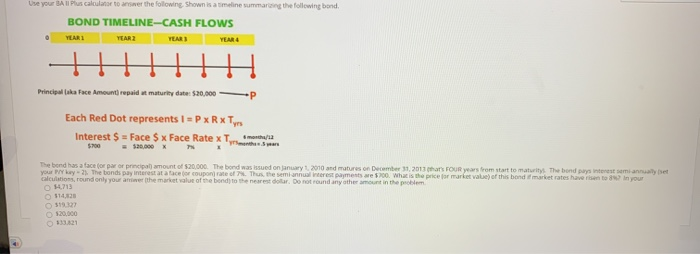

Question: 30) Use your BA II Plus calculator to answer the following Shown ismeline summarizing the following bond BOND TIMELINE-CASH FLOWS YLAR 1 YEAR 2 YEARS

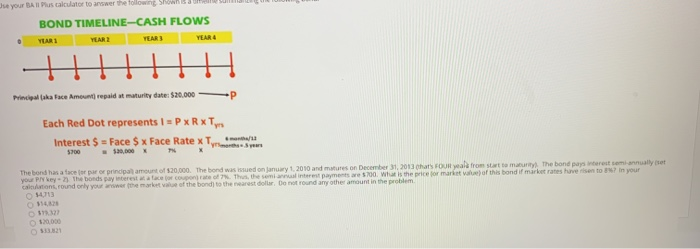

Use your BA II Plus calculator to answer the following Shown ismeline summarizing the following bond BOND TIMELINE-CASH FLOWS YLAR 1 YEAR 2 YEARS YEAR Principal aka Face Amount) repaid ut maturity date: $20,000 Each Red Dot represents I = P xRxTys Interest $ = Face $ x Face Rate XT = $20,000 The band has a face for par or principal amount of $20.000. The bond was issued on January 1, 2010 and matures on December 31, 2013 har Four years from start to maturity. The band pays interest semiannuale your way. The bonds pay interest at a face or coupon rate of 7%. Thus, the semiannual repayments are $700. What is the price for market value of this band market rates have rise to 8 in your calculations, round only you are the market value of the bond to the nearestor. Do not round any other amount in the problem 5713 14.00 120.000 Use your BA II Plus calculator to answer the following SHOWS BOND TIMELINE-CASH FLOWS VARI YLAR YEAR 3 YEAR 4 Principala Face Amourepaidat maturity date: 520.000 P Each Red Dot represents I = P xRxTy Interest $ = Face $ x Face Rate x Timesta/ yre 5700 x The band has a face tot par or principal amount of $20,000. The bond was issued on January , 2010 and matures on December 31, 2013 chats Four years from start to marry the bond pay rest temiannually set your Pey- The bonds panterest water constate of this the seminterest payments $700. What is the price for market of this bond if market rates have rise to ? in your Cartoni, round only your wehe market of the bond to the nearest dollar. Do not round any other amount in the problem 18 SU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts