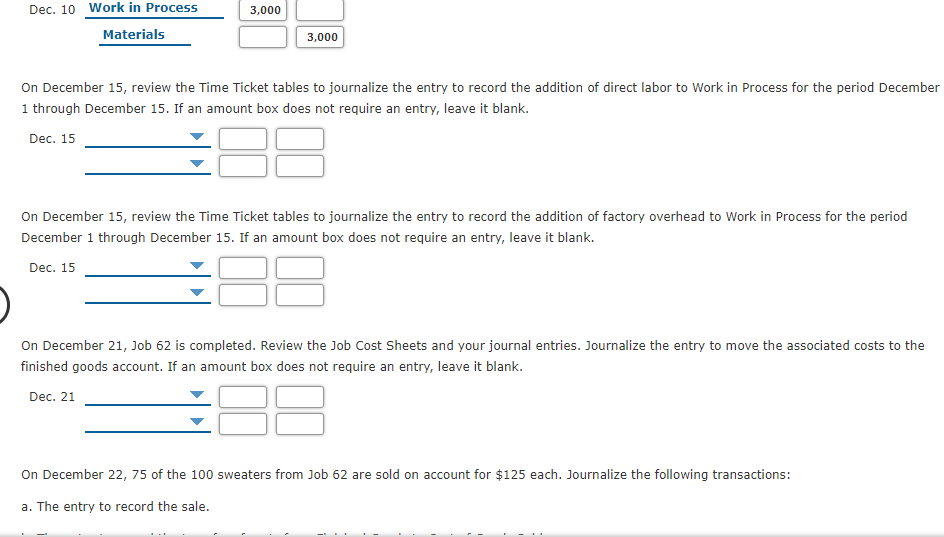

Question: 3,000 Dec. 10 Work in Process Materials 3,000 On December 15, review the Time Ticket tables to journalize the entry to record the addition of

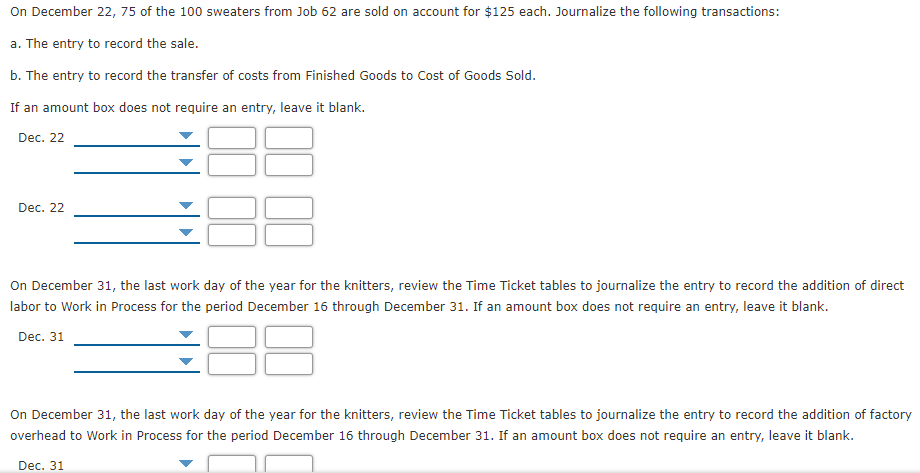

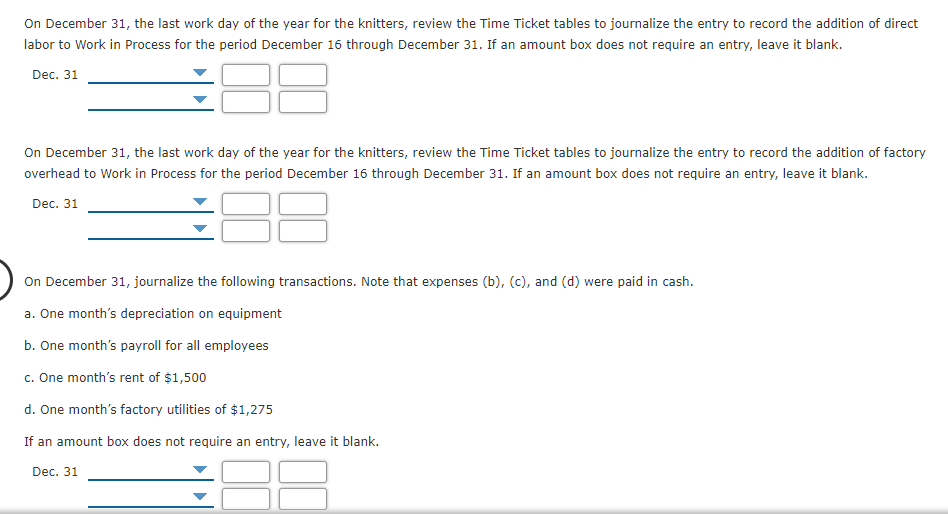

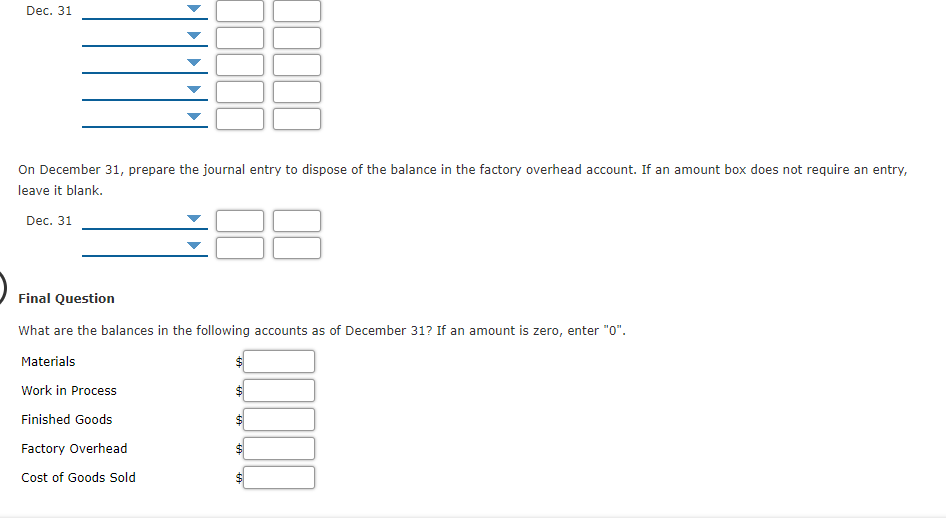

3,000 Dec. 10 Work in Process Materials 3,000 On December 15, review the Time Ticket tables to journalize the entry to record the addition of direct labor to Work in Process for the period December 1 through December 15. If an amount box does not require an entry, leave it blank. Dec. 15 On December 15, review the Time Ticket tables to journalize the entry to record the addition of factory overhead to Work in Process for the period December 1 through December 15. If an amount box does not require an entry, leave it blank. Dec. 15 On December 21, Job 62 is completed. Review the Job Cost Sheets and your journal entries. Journalize the entry to move the associated costs to the finished goods account. If an amount box does not require an entry, leave it blank. Dec. 21 On December 22, 75 of the 100 sweaters from Job 62 are sold on account for $125 each. Journalize the following transactions: a. The entry to record the sale. On December 22, 75 of the 100 sweaters from Job 62 are sold on account for $125 each. Journalize the following transactions: a. The entry to record the sale. b. The entry to record the transfer of costs from Finished Goods to cost of Goods Sold. If an amount box does not require an entry, leave it blank. Dec. 22 Dec. 22 On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of direct labor to Work in Process for the period December 15 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of factory overhead to Work in Process for the period December 16 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of direct labor to Work in Process for the period December 15 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of factory overhead to Work in Process for the period December 16 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 On December 31, journalize the following transactions. Note that expenses (b), (c), and (d) were paid in cash. a. One month's depreciation on equipment b. One month's payroll for all employees C. One month's rent of $1,500 d. One month's factory utilities of $1,275 If an amount box does not require an entry, leave it blank. Dec. 31 Dec. 31 On December 31, prepare the journal entry to dispose of the balance in the factory overhead account. If an amount box does not require an entry, leave it blank. Dec. 31 Final Question What are the balances in the following accounts as of December 31? If an amount is zero, enter "0". Materials Work in Process Finished Goods $ Factory Overhead Cost of Goods Sold $ 3,000 Dec. 10 Work in Process Materials 3,000 On December 15, review the Time Ticket tables to journalize the entry to record the addition of direct labor to Work in Process for the period December 1 through December 15. If an amount box does not require an entry, leave it blank. Dec. 15 On December 15, review the Time Ticket tables to journalize the entry to record the addition of factory overhead to Work in Process for the period December 1 through December 15. If an amount box does not require an entry, leave it blank. Dec. 15 On December 21, Job 62 is completed. Review the Job Cost Sheets and your journal entries. Journalize the entry to move the associated costs to the finished goods account. If an amount box does not require an entry, leave it blank. Dec. 21 On December 22, 75 of the 100 sweaters from Job 62 are sold on account for $125 each. Journalize the following transactions: a. The entry to record the sale. On December 22, 75 of the 100 sweaters from Job 62 are sold on account for $125 each. Journalize the following transactions: a. The entry to record the sale. b. The entry to record the transfer of costs from Finished Goods to cost of Goods Sold. If an amount box does not require an entry, leave it blank. Dec. 22 Dec. 22 On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of direct labor to Work in Process for the period December 15 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of factory overhead to Work in Process for the period December 16 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of direct labor to Work in Process for the period December 15 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of factory overhead to Work in Process for the period December 16 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 On December 31, journalize the following transactions. Note that expenses (b), (c), and (d) were paid in cash. a. One month's depreciation on equipment b. One month's payroll for all employees C. One month's rent of $1,500 d. One month's factory utilities of $1,275 If an amount box does not require an entry, leave it blank. Dec. 31 Dec. 31 On December 31, prepare the journal entry to dispose of the balance in the factory overhead account. If an amount box does not require an entry, leave it blank. Dec. 31 Final Question What are the balances in the following accounts as of December 31? If an amount is zero, enter "0". Materials Work in Process Finished Goods $ Factory Overhead Cost of Goods Sold $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts