Question: 306 Part 3 Financial Assets Problems Below average Above average 8-2 Easy Problems 8-1 EXPECTED RETURN A stock's returns have the following distribution 1-5 Demand

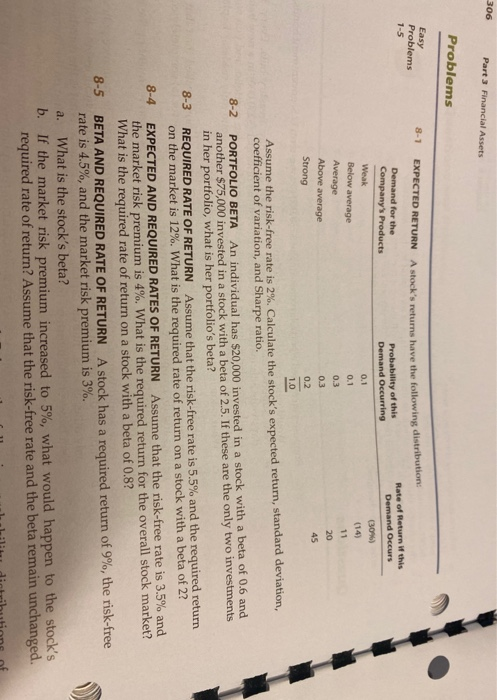

306 Part 3 Financial Assets Problems Below average Above average 8-2 Easy Problems 8-1 EXPECTED RETURN A stock's returns have the following distribution 1-5 Demand for the Rate of Return this Company's Products Probability of this Demand Occurs Demand Occurring Weak (30) 0.1 (14) 0.1 11 Average 0.3 20 0.3 45 Strong 0.2 1.0 Assume the risk-free rate is 2%. Calculate the stock's expected return, standard deviation, coefficient of variation, and Sharpe ratio. PORTFOLIO BETA An individual has $20,000 invested in a stock with a beta of 0.6 and another $75,000 invested in a stock with a beta of 2.5. If these are the only two investments in her portfolio, what is her portfolio's beta? 8-3 REQUIRED RATE OF RETURN Assume that the risk-free rate is 5.5% and the required return on the market is 12%. What is the required rate of return on a stock with a beta of 2? 8-4 EXPECTED AND REQUIRED RATES OF RETURN Assume that the risk-free rate is 3.5% and the market risk premium is 4%. What is the required return for the overall stock market? What is the required rate of return on a stock with a beta of 0.8? 8-5 BETA AND REQUIRED RATE OF RETURN A stock has a required return of 9%, the risk-free rate is 4.5%, and the market risk premium is 3%. a. What is the stock's beta? b. If the market risk premium increased to 5%, what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts