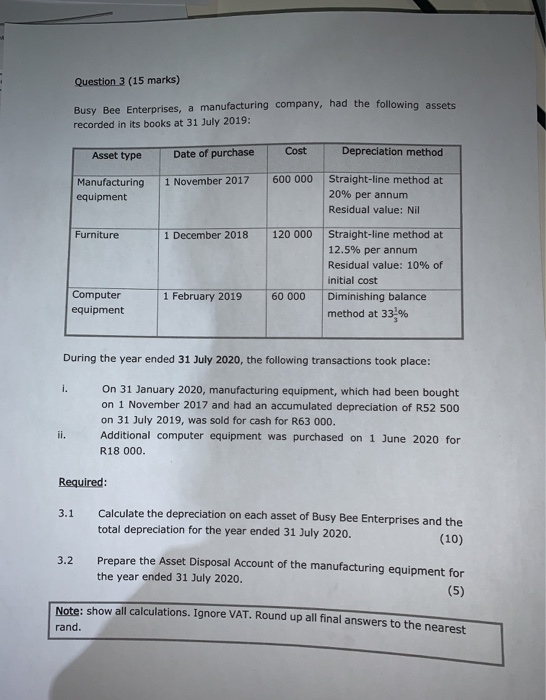

Question: 3.1 & 3.2 Question 3 (15 marks) Busy Bee Enterprises, a manufacturing company, had the following assets recorded in its books at 31 July 2019:

Question 3 (15 marks) Busy Bee Enterprises, a manufacturing company, had the following assets recorded in its books at 31 July 2019: Asset type Date of purchase Cost Depreciation method 1 November 2017 600 000 Manufacturing equipment Straight-line method at 20% per annum Residual value: Nil Furniture 1 December 2018 120 000 Straight-line method at 12.5% per annum Residual value: 10% of initial cost Diminishing balance method at 33% 1 February 2019 60 000 Computer equipment During the year ended 31 July 2020, the following transactions took place: i. On 31 January 2020, manufacturing equipment, which had been bought on 1 November 2017 and had an accumulated depreciation of R52 500 on 31 July 2019, was sold for cash for R63 000. Additional computer equipment was purchased on 1 June 2020 for R18 000 ii. Required: 3.1 Calculate the depreciation on each asset of Busy Bee Enterprises and the total depreciation for the year ended 31 July 2020. (10) 3.2 Prepare the Asset Disposal Account of the manufacturing equipment for the year ended 31 July 2020. (5) Note: show all calculations. Ignore VAT. Round up all final answers to the nearest rand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts