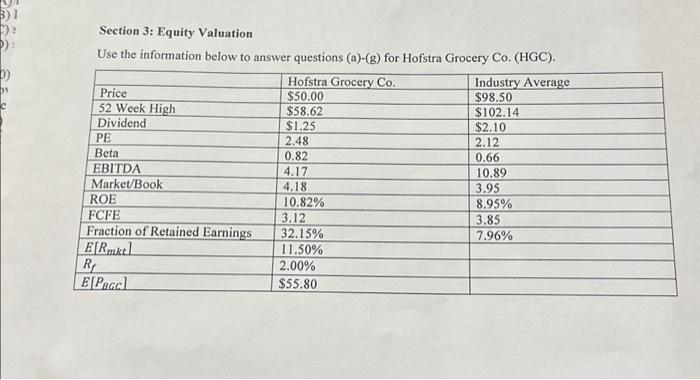

Question: 3)1 C) s (): 0) Section 3: Equity Valuation Use the information below to answer questions (a)-(g) for Hofstra Grocery Co. (HGC). Price 52 Week

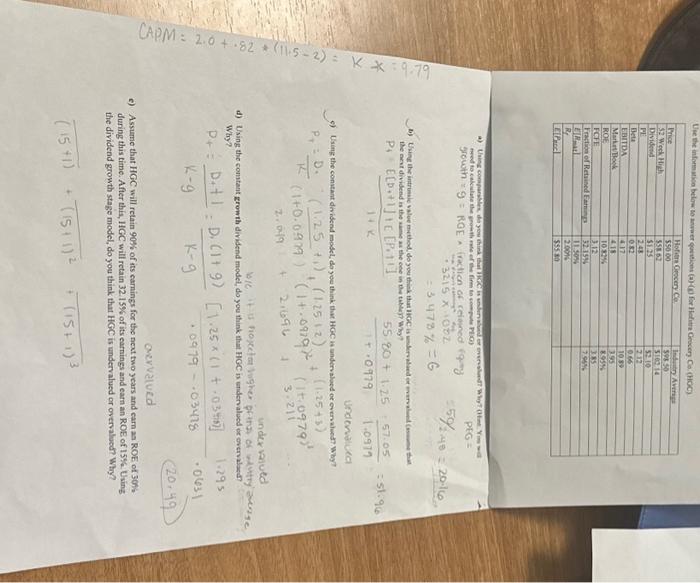

Section 3: Equity Valuation Use the information below to answer questions (a)-( g ) for Hofstra Grocery Co. (HGC). a) PtG= 73215x+107259/248=2016 Undenaluel under vanued d) Using the conntant growth divisend modet, do you think that HGC is endervalued of overvilaed? arvilued e) Assume that HGC will retain 90% of its carnings for the next two years and earn aa ROE of 30%. during this time. After this, 1 GGC will retain 32.15% of its earnings and earn an ROE of 15%. Using the dividend growth stage model, do you think that HGC is undervalued or overvalued? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts