Question: 31. Cold Boxes Ltd. has 100 bonds outstanding (maturity value $1.000). The required rate of return on these bonds is currently 10 percent, and interest

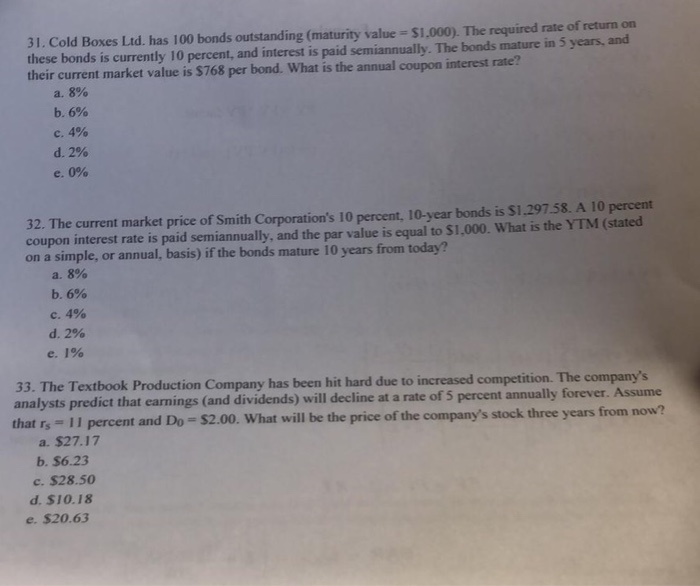

31. Cold Boxes Ltd. has 100 bonds outstanding (maturity value $1.000). The required rate of return on these bonds is currently 10 percent, and interest is paid semiannually. The bonds mature in 5 years, and their current market value is $768 per bond. What is the annual coupon interest rate? a. 8% b. 6% . 4% d.2% e, 0% 32. The current market price of Smith Corporation's 10 percent, 10-year bonds is S1.29758. A 10 percent coupon interest rate is paid semiannually, and the par value is equal to $1,000. What is the YTM (stated on a simple, or annual, basis) if the bonds mature 10 years from today? a. 8% b. 6% . 4% d. 2% e. 1% 33. The Textbook Production Company has been hit hard due to increased competition. The company's analysts predict that earnings (and dividends) will decline at a rate of 5 percent annually forever. Assume that rs -11 percent and Do- $2.00. What price of the t will be the price of the company's stock three years from now? a. $27.17 b. $6.23 c. $28.50 d. $10.18 e. $20.63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts