Question: 31. Entity A acquires a building for P1,000,000. The building is to be leased out under various operating leases. The building has an estimated useful

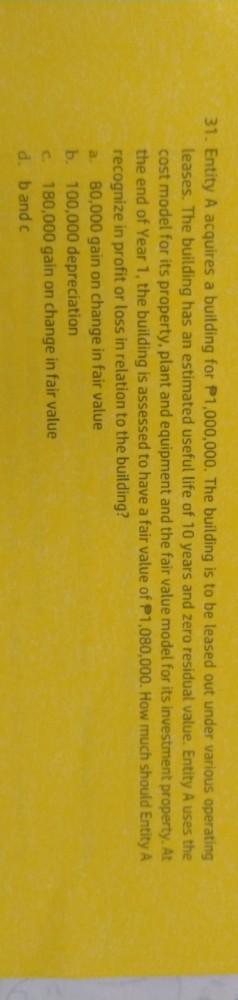

31. Entity A acquires a building for P1,000,000. The building is to be leased out under various operating leases. The building has an estimated useful life of 10 years and zero residual value. Entity A uses the cost model for its property, plant and equipment and the fair value model for its investment property. At the end of Year 1, the building is assessed to have a fair value of P1,080,000. How much should Entity A recognize in profit or loss in relation to the building? B0,000 gain on change in fair value b. 100.000 depreciation c180,000 gain on change in fair value d.bandc a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock