Question: 3.1 Explain why the net present value (NPV) and internal rate of return (IRR) capital budgeting techniques are preferred to other methods of project evaluation.

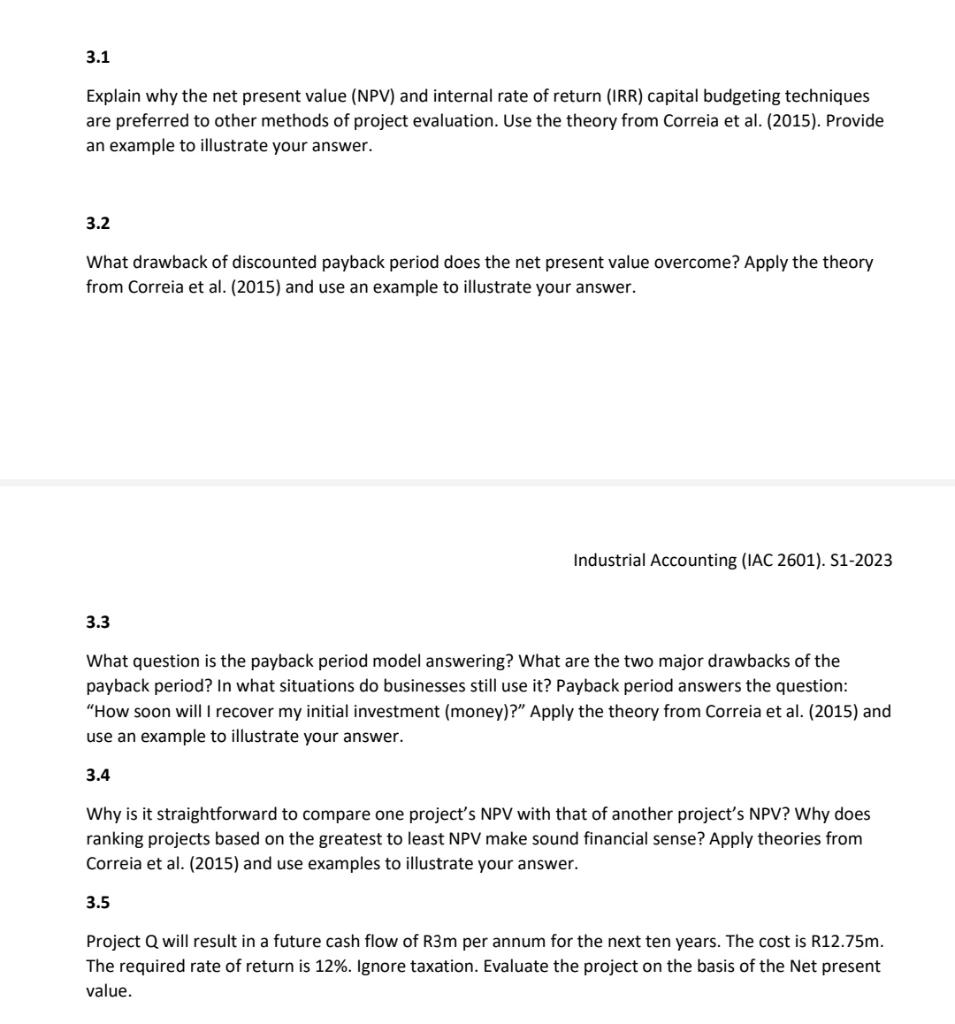

3.1 Explain why the net present value (NPV) and internal rate of return (IRR) capital budgeting techniques are preferred to other methods of project evaluation. Use the theory from Correia et al. (2015). Provide an example to illustrate your answer. 3.2 What drawback of discounted payback period does the net present value overcome? Apply the theory from Correia et al. (2015) and use an example to illustrate your answer. 3.3 What question is the payback period model answering? What are the two major drawbacks of the payback period? In what situations do businesses still use it? Payback period answers the question: "How soon will I recover my initial investment (money)?" Apply the theory from Correia et al. (2015) and use an example to illustrate your answer. 3.4 Why is it straightforward to compare one project's NPV with that of another project's NPV? Why does ranking projects based on the greatest to least NPV make sound financial sense? Apply theories from Correia et al. (2015) and use examples to illustrate your answer. 3.5 Project Q will result in a future cash flow of R3m per annum for the next ten years. The cost is R12.75m. The required rate of return is 12%. Ignore taxation. Evaluate the project on the basis of the Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts