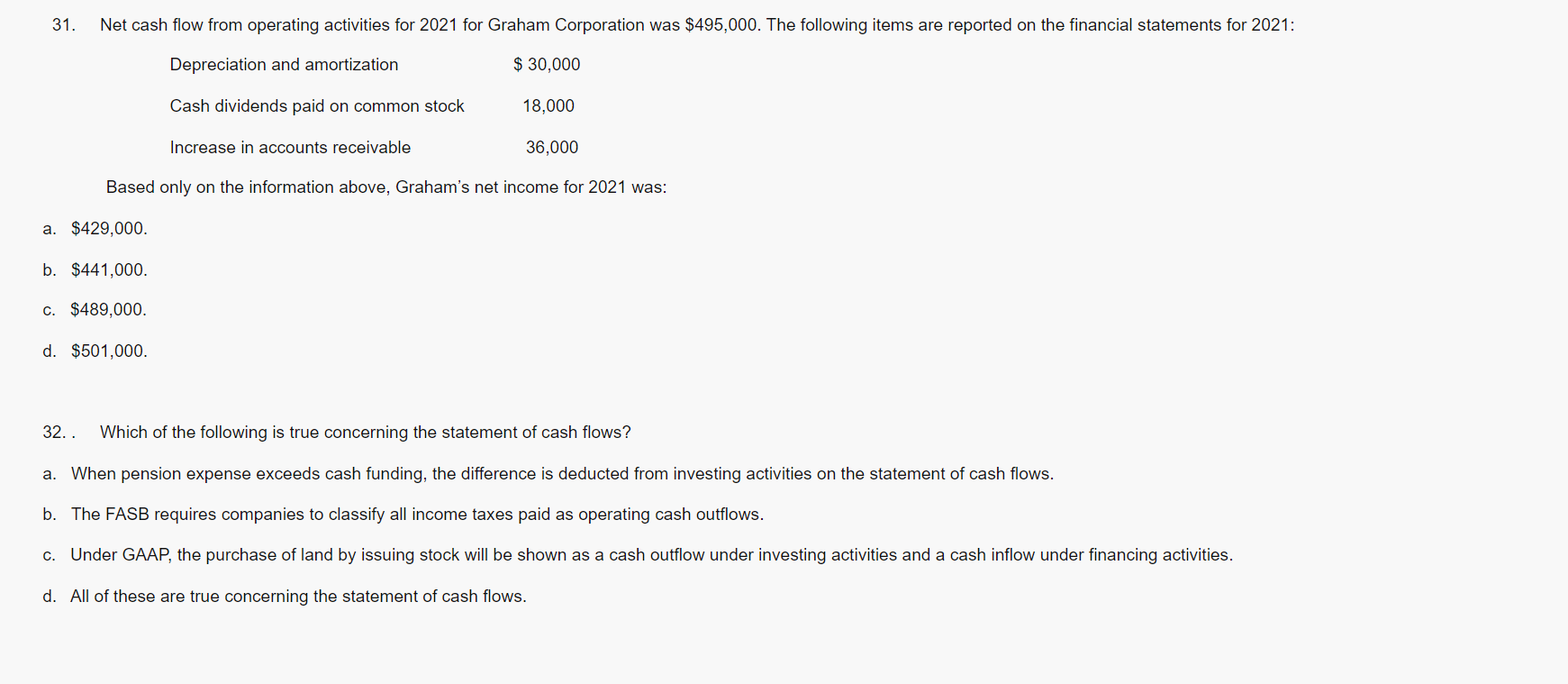

Question: 31. Net cash flow from operating activities for 2021 for Graham Corporation was $495,000. The following items are reported on the financial statements for 2021:

31. Net cash flow from operating activities for 2021 for Graham Corporation was $495,000. The following items are reported on the financial statements for 2021: Depreciation and amortization $ 30,000 Cash dividends paid on common stock 18,000 Increase in accounts receivable 36,000 Based only on the information above, Graham's net income for 2021 was: a. $429,000. b. $441,000. c. $489,000. d. $501,000. 32... Which of the following is true concerning the statement of cash flows? a. When pension expense exceeds cash funding, the difference is deducted from investing activities on the statement of cash flows. b. The FASB requires companies to classify all income taxes paid as operating cash outflows. c. Under GAAP, the purchase of land by issuing stock will be shown as a cash outflow under investing activities and a cash inflow under financing activities. d. All of these are true concerning the statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts