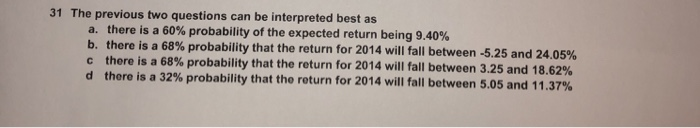

Question: 31 The previous two questions can be interpreted best as a. there is a 60% probability of the expected return being 9.40% b. there is

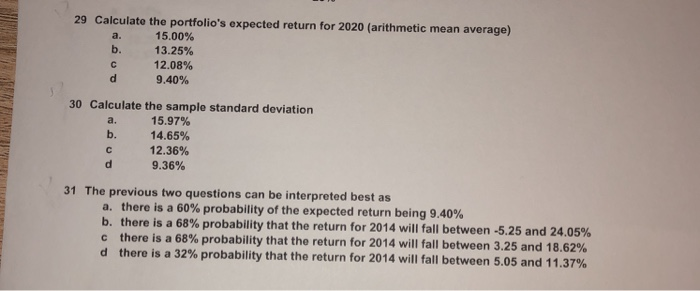

31 The previous two questions can be interpreted best as a. there is a 60% probability of the expected return being 9.40% b. there is a 68% probability that the return for 2014 will fall between -5.25 and 24.05% c there is a 68% probability that the return for 2014 will fall between 3.25 and 18.62% d there is a 32% probability that the return for 2014 will fall between 5.05 and 11.37% 29 Calculate the portfolio's expected return for 2020 (arithmetic mean average) a. 15.00% b. 13.25% 12.08% d 9.40% 30 Calculate the sample standard deviation a. 15.97% b. 14.65% 12.36% d 9.36% 31 The previous two questions can be interpreted best as a. there is a 60% probability of the expected return being 9.40% b. there is a 68% probability that the return for 2014 will fall between -5.25 24.05% c there is a 68% probability that the return for 2014 will fall between 3.25 and 18.62% d there is a 32% probability that the return for 2014 will fall between 5.05 and 11.37% 31 The previous two questions can be interpreted best as a. there is a 60% probability of the expected return being 9.40% b. there is a 68% probability that the return for 2014 will fall between -5.25 and 24.05% c there is a 68% probability that the return for 2014 will fall between 3.25 and 18.62% d there is a 32% probability that the return for 2014 will fall between 5.05 and 11.37% 29 Calculate the portfolio's expected return for 2020 (arithmetic mean average) a. 15.00% b. 13.25% 12.08% d 9.40% 30 Calculate the sample standard deviation a. 15.97% b. 14.65% 12.36% d 9.36% 31 The previous two questions can be interpreted best as a. there is a 60% probability of the expected return being 9.40% b. there is a 68% probability that the return for 2014 will fall between -5.25 24.05% c there is a 68% probability that the return for 2014 will fall between 3.25 and 18.62% d there is a 32% probability that the return for 2014 will fall between 5.05 and 11.37%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts