Question: 31) What is the approximate yield to maturity for a $1,000 par value bond selling for $1,120 that matures in 6 years and pays 12

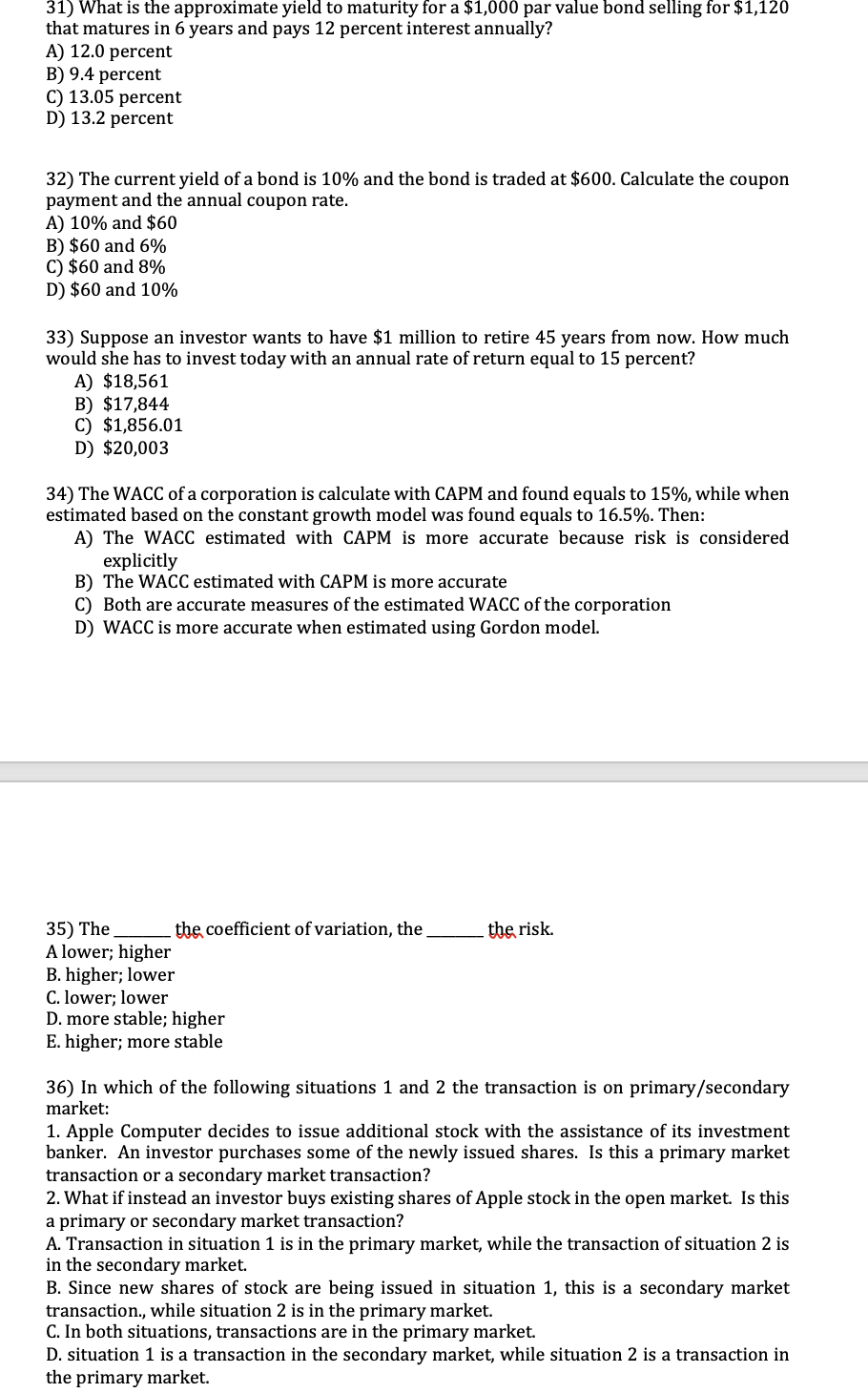

31) What is the approximate yield to maturity for a $1,000 par value bond selling for $1,120 that matures in 6 years and pays 12 percent interest annually? A) 12.0 percent B) 9.4 percent C) 13.05 percent D) 13.2 percent 32) The current yield of a bond is 10% and the bond is traded at $600. Calculate the coupon payment and the annual coupon rate. A) 10% and $60 B) $60 and 6% C) $60 and 8% D) $60 and 10% 33) Suppose an investor wants to have $1 million to retire 45 years from now. How much would she has to invest today with an annual rate of return equal to 15 percent? A) $18,561 B) $17,844 C) $1,856.01 D) $20,003 34) The WACC of a corporation is calculate with CAPM and found equals to 15%, while when estimated based on the constant growth model was found equals to 16.5%. Then: A) The WACC estimated with CAPM is more accurate because risk is considered explicitly B) The WACC estimated with CAPM is more accurate C) Both are accurate measures of the estimated WACC of the corporation D) WACC is more accurate when estimated using Gordon model. the risk. 35) The the coefficient of variation, the A lower; higher B. higher; lower C. lower; lower D. more stable; higher E. higher; more stable 36) In which of the following situations 1 and 2 the transaction is on primary/secondary market: 1. Apple Computer decides to issue additional stock with the assistance of its investment banker. An investor purchases some of the newly issued shares. Is this a primary market transaction or a secondary market transaction? 2. What if instead an investor buys existing shares of Apple stock in the open market. Is this a primary or secondary market transaction? A. Transaction in situation 1 is in the primary market, while the transaction of situation 2 is in the secondary market. B. Since new shares of stock are being issued in situation 1, this is a secondary market transaction., while situation 2 is in the primary market. C. In both situations, transactions are in the primary market. D. situation 1 is a transaction in the secondary market, while situation 2 is a transaction in the primary market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts