Question: 3.10 please correct what i am doing wrong, thank you for helping Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales for Item 88-HX are

3.10

please correct what i am doing wrong, thank you for helping

please correct what i am doing wrong, thank you for helping

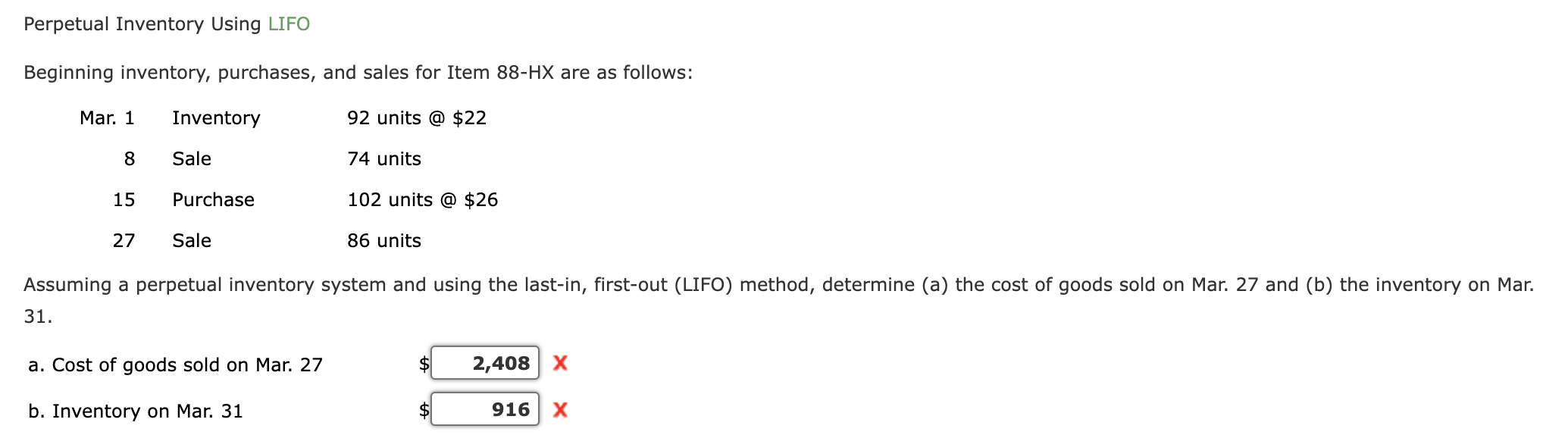

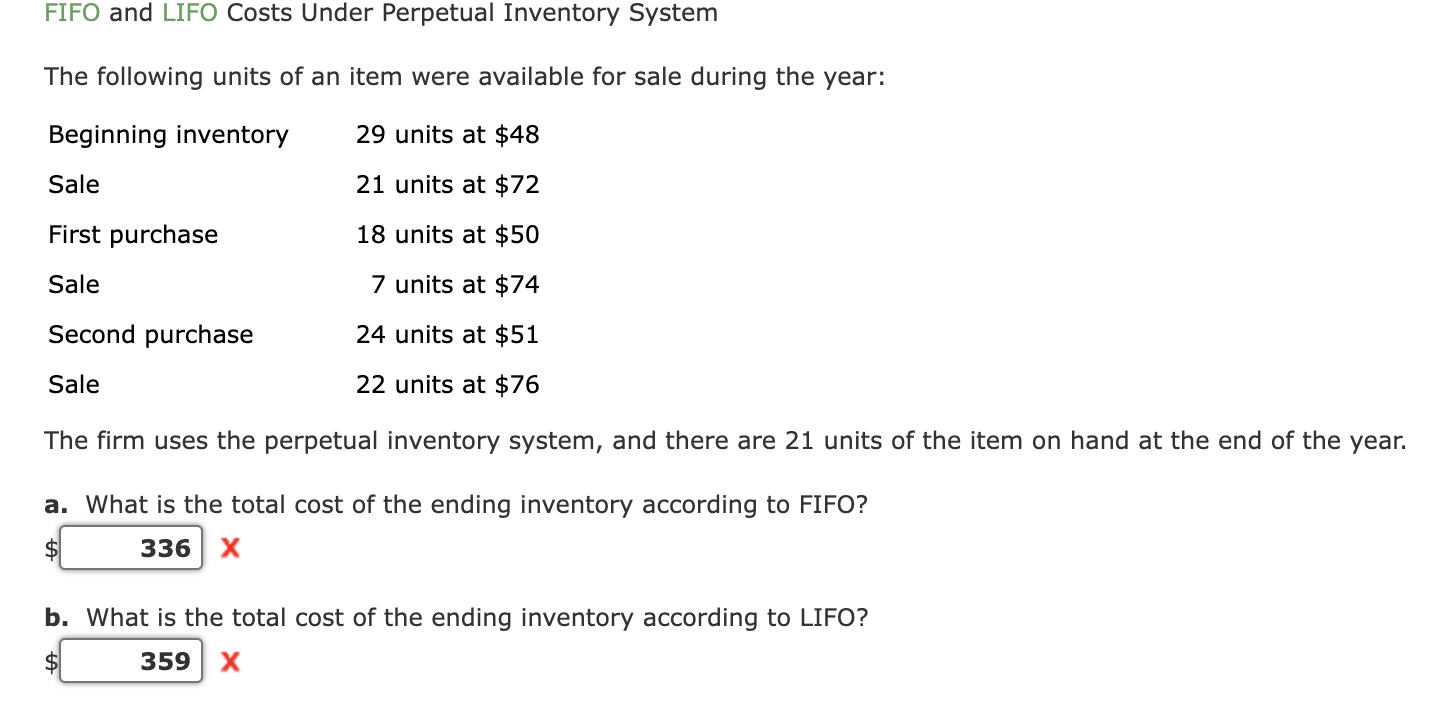

Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales for Item 88-HX are as follows: Mar. 1 Inventory 92 units @ $22 8 Sale 74 units 15 Purchase 102 units @ $26 27 Sale 86 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of goods sold on Mar. 27 and (b) the inventory on Mar. 31. a. Cost of goods sold on Mar. 27 2,408 X b. Inventory on Mar. 31 916 X FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: Beginning inventory 29 units at $48 Sale 21 units at $72 First purchase 18 units at $50 Sale 7 units at $74 Second purchase 24 units at $51 Sale 22 units at $76 The firm uses the perpetual inventory system, and there are 21 units of the item on hand at the end of the year. a. What is the total cost of the ending inventory according to FIFO? $ 336 b. What is the total cost of the ending inventory according to LIFO? 359 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts