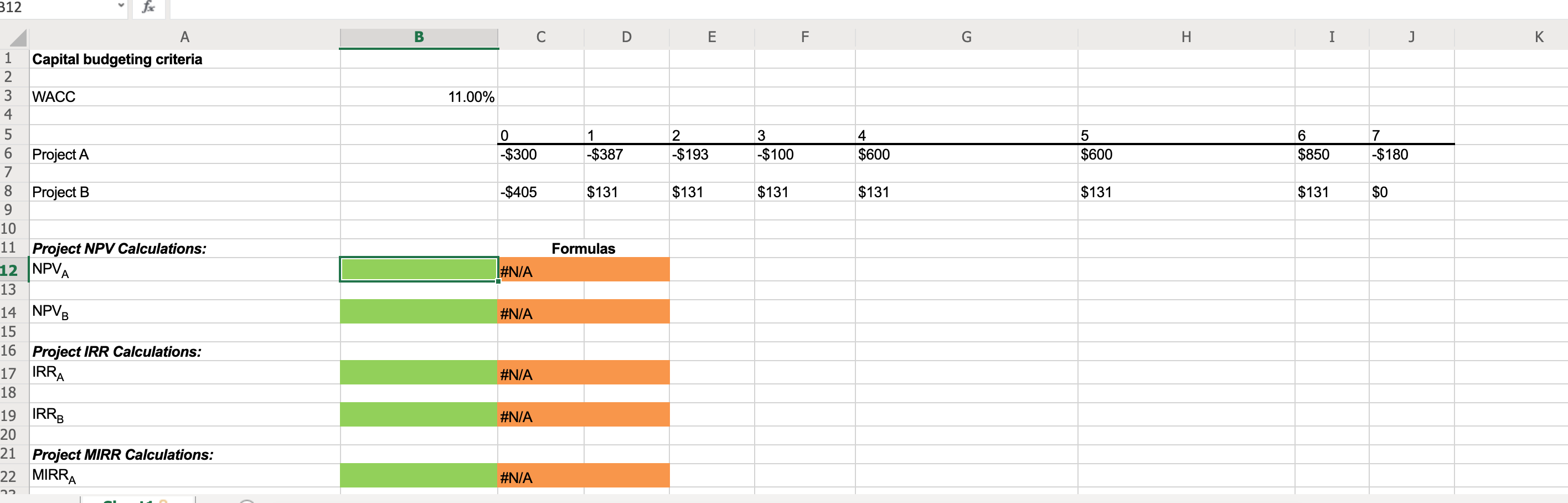

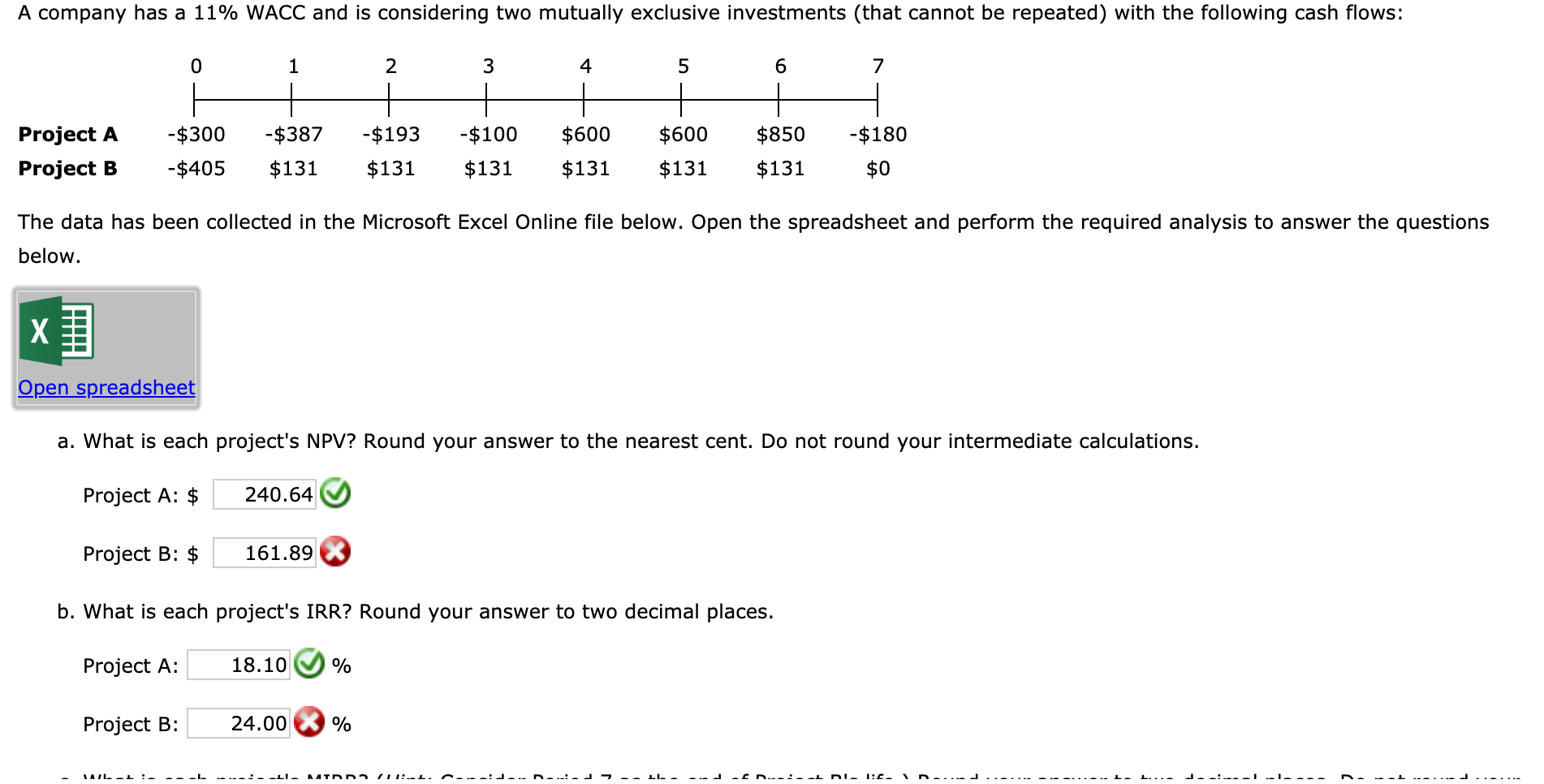

Question: 312 A C D E G I K 1 2 Capital budgeting criteria M WACC 11.00% Project A -$300 $387 2 $193 $193 $100 -$300

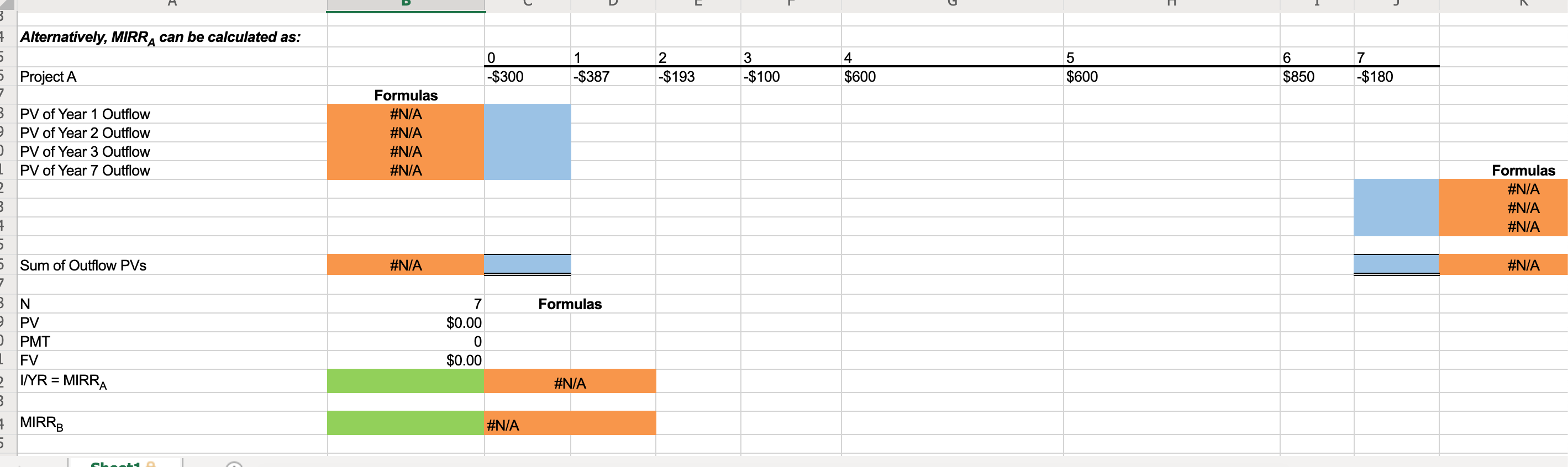

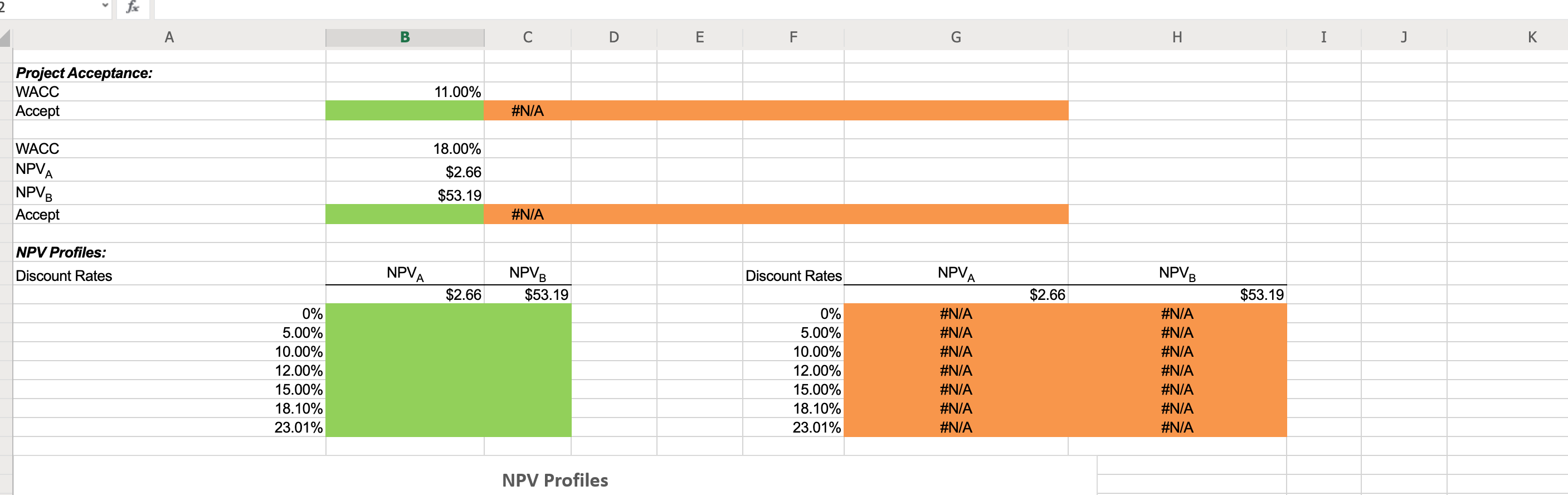

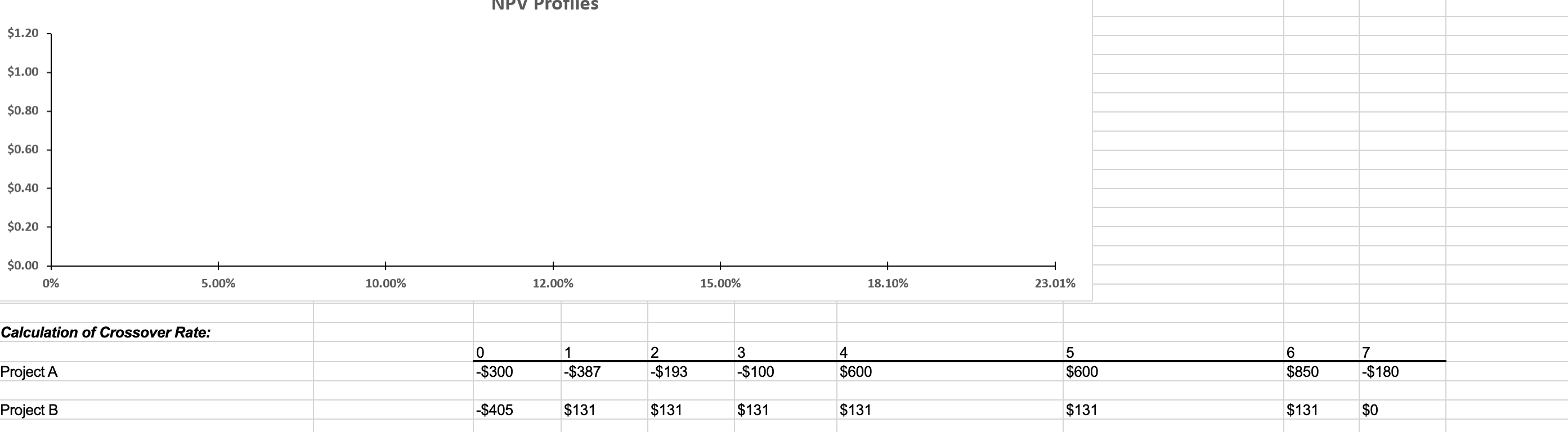

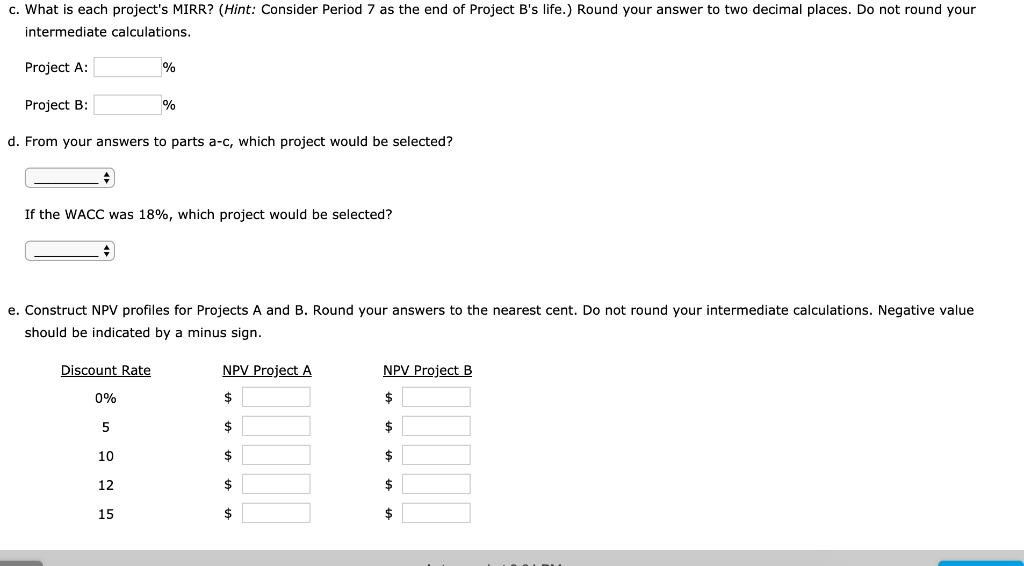

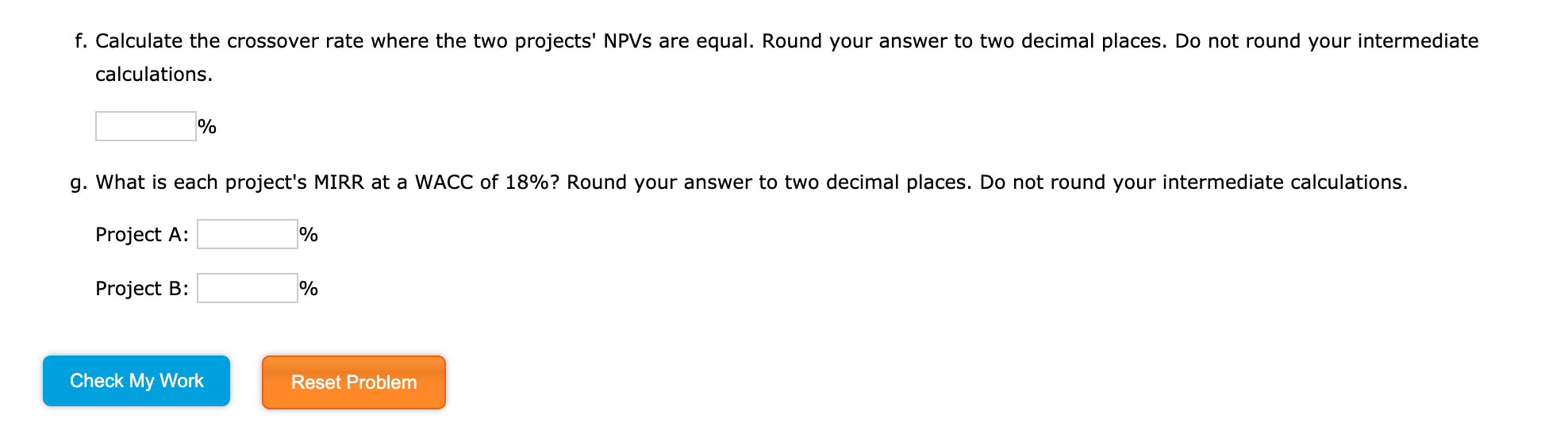

312 A C D E G I K 1 2 Capital budgeting criteria M WACC 11.00% Project A -$300 $387 2 $193 $193 $100 -$300 -$387 -$100 $600 $600 $850 -$180 ONDO Project B -$405 $131 $131 $131 $131 $131 $131 $0 9. 10 Formulas #N/A 11 Project NPV Calculations: 12 NPVA 13 14 NPVB 15 16 Project IRR Calculations: 17 IRRA #N/A #N/A 18 #N/A 19 IRRE 20 21 Project MIRR Calculations: 22 MIRRA #N/A 23 Alternatively, MIRR, can be calculated as: A 1 6 $850 Project A -$300 -$387 -$193 -$100 $600 $600 -$180 B PV of Year 1 Outflow PV of Year 2 Outflow PV of Year 3 Outflow PV of Year 7 Outflow Formulas #N/A #N/A #N/A #N/A Formulas #N/A #N/A #N/A 5 Sum of Outflow PVS #N/A #N/A Formulas $0.00 BN 2 PV PMT 1 FV I/YR = MIRRA $0.00 #N/A MIRRB #N/A UU C D E I J Project Acceptance: WACC Accept 11.00% #N/A WACC NPVA 18.00% $2.66 $53.19 NPVB Accept #N/A NPV Profiles: Discount Rates NPVA Discount Rates NPVA NPVB NPVB. $53.19 $2.66 $2.66 $53.19 0% 5.00% 10.00% 12.00% 15.00% 18.10% 23.01% 0% 5.00% 10.00% 12.00% 15.00% 18.10% 23.01% #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A NPV Profiles NPV Profiles $ 1.20 $1.00 $0.80 $0.60 $0.40 - $0.20 $0.00 + 12.00% 0% 5.00% 10.00% 12.00% 15.00% 5.00% 18.10% 28,10% 23.01% Calculation of Crossover Rate: 7 5 $600 Project A -$300 -$387 -$193 -$100 $600 $850 -$180 5300 -S405 5387 $131 5193 $131 $100 $131 $800 $131 Project B -$405 $131 $131 $131 $131 $131 $131 $0 $0 Project Delta #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A Crossover Rate = IRRA #N/A Project MIRR Calculations at WACC = 18% WACC 18.00% MIRRA MIRRB #N/A #N/A A company has a 11% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: 0 1 2 3 - 4 5 6 Project A Project B -$300 -$405 -$387 $131 -$193 $131 -$100 $131 $600 $131 $600 $131 $850 $131 -$180 $0 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A: $ 240.64 Project B: $ 161.89 b. What is each project's IRR? Round your answer to two decimal places. Project A: 18.10 % Project B: 24.00 % WL-L!. ---L---:.-11. MIN I -. --!don .d7-- IL.--d-en--'.- Di. 1:0. Inc.-d....... ........ ..... d.- --- - ---- - . -- ---..-d ... c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. Project A: % Project B: % d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate calculations. Negative value should be indicated by a minus sign. Discount Rate NPV Project A NPV Project B f. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. Do not round your intermediate calculations. % g. What is each project's MIRR at a WACC of 18%? Round your answer to two decimal places. Do not round your intermediate calculations. Project A: Project B: Check My Work Reset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts