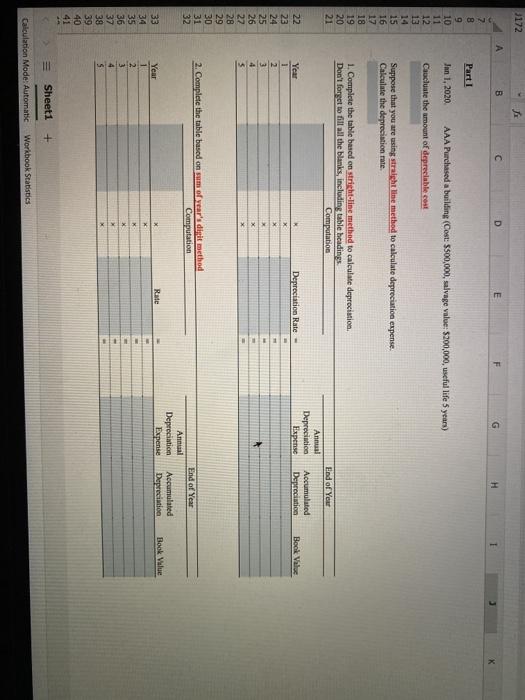

Question: 3172 B D E 3 Part 1 2 8 9 10 11 12 13 Jan 1, 2020 AAA Purchased a building (Cost: $500,000, salvage value:

3172 B D E 3 Part 1 2 8 9 10 11 12 13 Jan 1, 2020 AAA Purchased a building (Cost: $500,000, salvage value: $200,000, useful life 5 years) Caucluste the amount of deprecluble cost Suppose that you are using straight line method to calculate depreciation expense. Calculate the depreciation rate. 15 16 17 18 19 20 21 1. Complete the table based on stricht-line method to calculate depreciation. Don't forget to fill all the blanks, including table headings Computation End of Yeur Annual Depreciation M Depreciation Rate - Accumulated Depreciation Expense Book Value x 22 23 24 25 26 27 28 29 30 31 32 Year 1 2 3 4 $ x 2. Complete the table based on sum of year's digit method Computation End of Year Annual Depreciation Expense Accumulated Depreciation Rate Book Value x K 33 34 35 36 37 38 39 40 41 Year 1 2 3 4 3 Sheet1 + Calculation Mode: Automatic Workbook Statistics

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts