Question: $318,600(20% variable and 80% fixed); and manufacturing overhead $413,000(70% variable and 30% fixed). Top management has asked you to do a CVP analysis so that

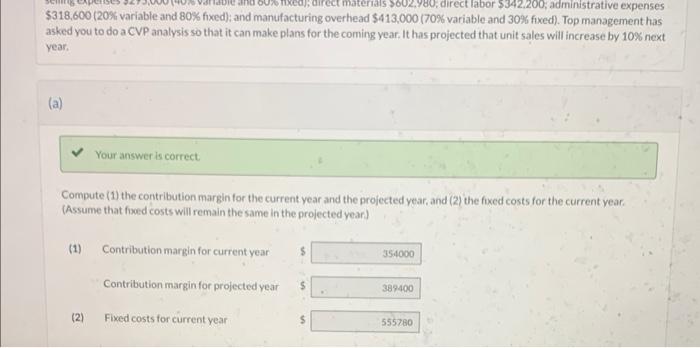

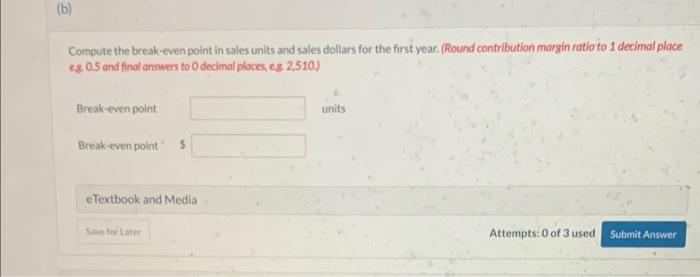

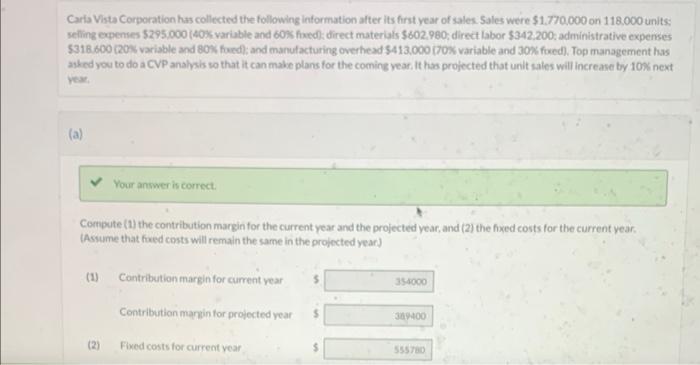

$318,600(20% variable and 80% fixed); and manufacturing overhead $413,000(70% variable and 30% fixed). Top management has asked you to do a CVP analysis so that it can make plans for the coming year. It has projected that unit sales will increase by 10% next year. (a) Your answer is correct. Compute (1) the contribution margin for the current year and the projected year, and (2) the fixed costs for the current year. (Assume that foxed costs will remain the same in the projected year) (1) Contribution margin for current year Contribution margin for projected year $ (2) Fixed costs for current year 5 Compute the break-even point in sales units and sales dollars for the first year, (Round contribution margin ratio to 1 decimal place es. 0.5 and final anwers to 0 decimal ploces, es. 2,510. Break-even point units Break-even point " 5 Caria Vista Corporation has collected the following information after its first year of sales. Sales were $1.770.000 on 118.000 units: seling expenses $295,000 (405: variable and 60\%\$ foxed) direct materials $602.960; direct labor $342.200, administrative expenses 5318.600 (20s, variable and 80% fuedl; and manufacturing overhead 5413.000 (70s variable and 30% fuxed). Top management has asked you to do a CVP analysis so that it can mabe plans for the coming vear. it has projected that unit sales will increase by 10% next Year, (a) Your answer is correct. Compute (1) the contribution margin for the current year and the projected year, and (2) the fyed costs for the current year. (Assume that fied costs will remain the same in the propected year) (1) Contribution margin for current vear Contribution manin for projected year $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts