Question: 32. 32. Consider the following statements : I. A model based on the proposition that any stock's required rate of return is equal to the

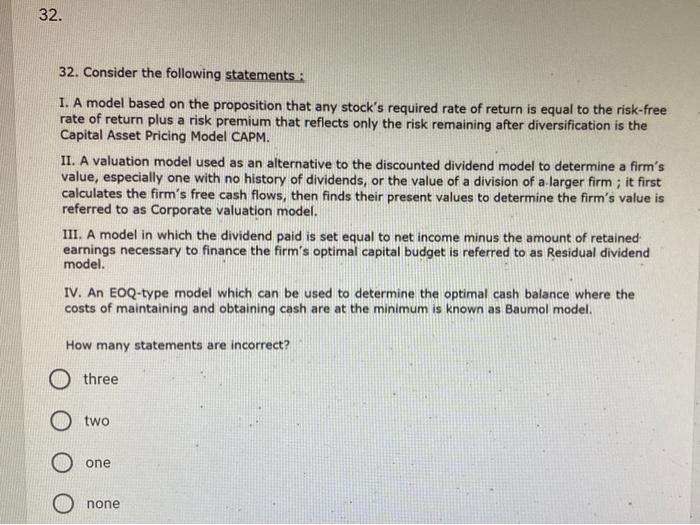

32. 32. Consider the following statements : I. A model based on the proposition that any stock's required rate of return is equal to the risk-free rate of return plus a risk premium that reflects only the risk remaining after diversification is the Capital Asset Pricing Model CAPM. II. A valuation model used as an alternative to the discounted dividend model to determine a firm's value, especially one with no history of dividends, or the value of a division of a larger firm ; it first calculates the firm's free cash flows, then finds their present values to determine the firm's value is referred to as Corporate valuation model. III. A model in which the dividend paid is set equal to net income minus the amount of retained earnings necessary to finance the firm's optimal capital budget is referred to as Residual dividend model. IV. An EOQ-type model which can be used to determine the optimal cash balance where the costs of maintaining and obtaining cash are at the minimum known as Baumol model. How many statements are incorrect? O three two one none

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts