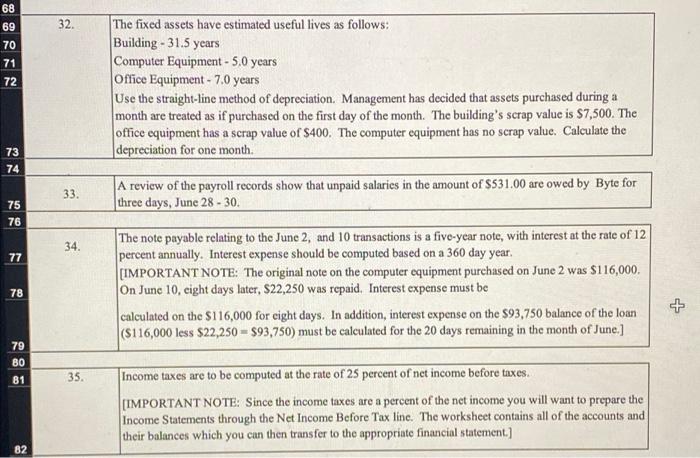

Question: 32 - 35 please! 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment

68 69 32 - 70 71 72 The fixed assets have estimated useful lives as follows: Building -31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $7,500. The office equipment has a scrap value of $400. The computer equipment has no scrap value. Calculate the depreciation for one month. 73 74 33. A review of the payroll records show that unpaid salaries in the amount of $31.00 are owed by Byte for three days, June 28 - 30 75 76 34. 77 The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. (IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $116,000. On June 10, eight days later, $22,250 was repaid. Interest expense must be calculated on the $116,000 for eight days. In addition, interest expense on the $93,750 balance of the loan (5116,000 less $22,250 = $93,750) must be calculated for the 20 days remaining in the month of June.] 78 + 79 81 35. Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.) 82 68 69 32 - 70 71 72 The fixed assets have estimated useful lives as follows: Building -31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $7,500. The office equipment has a scrap value of $400. The computer equipment has no scrap value. Calculate the depreciation for one month. 73 74 33. A review of the payroll records show that unpaid salaries in the amount of $31.00 are owed by Byte for three days, June 28 - 30 75 76 34. 77 The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. (IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $116,000. On June 10, eight days later, $22,250 was repaid. Interest expense must be calculated on the $116,000 for eight days. In addition, interest expense on the $93,750 balance of the loan (5116,000 less $22,250 = $93,750) must be calculated for the 20 days remaining in the month of June.] 78 + 79 81 35. Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.) 82

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts