Question: 3.2 Answer: 3.3. Ali found an old Nutribullet smoothie maker that he wants to use for his business. Unfortunately, he can't remember what he

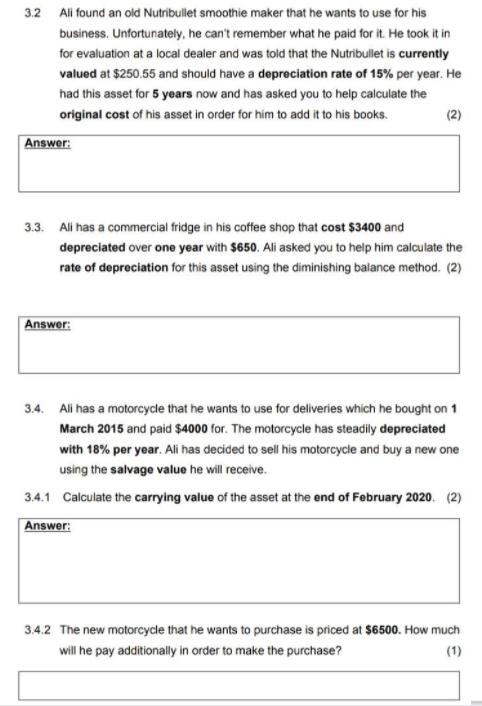

3.2 Answer: 3.3. Ali found an old Nutribullet smoothie maker that he wants to use for his business. Unfortunately, he can't remember what he paid for it. He took it in for evaluation at a local dealer and was told that the Nutribullet is currently valued at $250.55 and should have a depreciation rate of 15% per year. He had this asset for 5 years now and has asked you to help calculate the original cost of his asset in order for him to add it to his books. Answer: 3.4. (2) Ali has a commercial fridge in his coffee shop that cost $3400 and depreciated over one year with $650. Ali asked you to help him calculate the rate of depreciation for this asset using the diminishing balance method. (2) Ali has a motorcycle that he wants to use for deliveries which he bought on 1 March 2015 and paid $4000 for. The motorcycle has steadily depreciated with 18% per year. Ali has decided to sell his motorcycle and buy a new one using the salvage value he will receive. 3.4.1 Calculate the carrying value of the asset at the end of February 2020. (2) Answer: 3.4.2 The new motorcycle that he wants to purchase is priced at $6500. How much will he pay additionally in order to make the purchase? (1)

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

32 To calculate the original cost of Alis Nutribullet smoothie maker we can use the formula for calculating the present value of an asset Original Cos... View full answer

Get step-by-step solutions from verified subject matter experts